Occasionally I get to write feature stories for Workforce’s sister publication, Talent Economy, and the most recent assignment is on the topic of diversity (or lack thereof) in entrepreneurship.

A lot of my findings and interviews I’m saving for the article itself, which comes out later this year, but there was one benefits-related piece of information that I’d like to share with you today in Working Well.

A November 2017 story in Black Enterprise shed some light on some interesting trends in the entrepreneurship/small business space. First, women of color are the fastest-growing segment of the country’s economy, and a recent poll found that 56 percent of female entrepreneurs find access to birth control a vital health benefit for them because it allows them to decide:

- A) If and when they want to have children.

- B) To advance their careers and start their businesses without that responsibility.

What do you think? As HR professionals, do you feel like there are certain benefits that would make entrepreneurship and small business ownership a more attainable goal for an underrepresented group in the entrepreneurship community? Maybe women, or a certain race, or a certain age group, or a certain geographical region. Feel free to share your thoughts with me in comments section below or at my Twitter handle, @andie_burjek.

Not only do entrepreneurs value certain benefits, but they can impact the benefits landscape. I recently spoke with Marion McGovern, the author of Thriving in the Gig Economy, about baby boomers’ participation in the gig economy. She also informed me about benefits and how entrepreneurs are stepping up to fill the gaps for gig economy workers who do not have access to benefits. What policymakers aren’t addressing yet, some entrepreneurs are.

[Related content: “Gig Economy Workers May See Benefits Relief”]

She gave a few examples of these entrepreneurs. ShiftPixy is focused on low-earning shift workers in restaurants like busboys or servers. These people have difficulty getting benefits for a variety of reasons, for example because they do not get enough hours to qualify for benefits. Using this app, employee could take shifts at more than one restaurant and work enough hours at various places to qualify for benefits as a ShiftPixy employee.

“[The restaurants] are willing to pay more to take that administrative burden off them,” said McGovern. “Meanwhile, the employees get benefits and get to schedule shifts that work for them.”

She mentioned a few other companies that aim to get benefits to employees who don’t have access to them — Stride Health, Honest Dollar and Bunker Insurance, among others.

“The marketplace isn’t reacting traditionally. And it’s not the policymakers or regulators [but the] entrepreneurs out there who are saying, ‘There’s friction out there in the marketplace. Let’s get rid of some of it.’ That’s very empowering,” said McGovern.

I don’t know much about these companies, but it is fascinating that they’re stepping up to try to solve this problem. It’s something that’s not going away anytime soon. As more people rely on contingent work, how they will they access benefits becomes more important. Contract work is booming, and 32 million Americans earn their living that way, according to a recent NPR article.

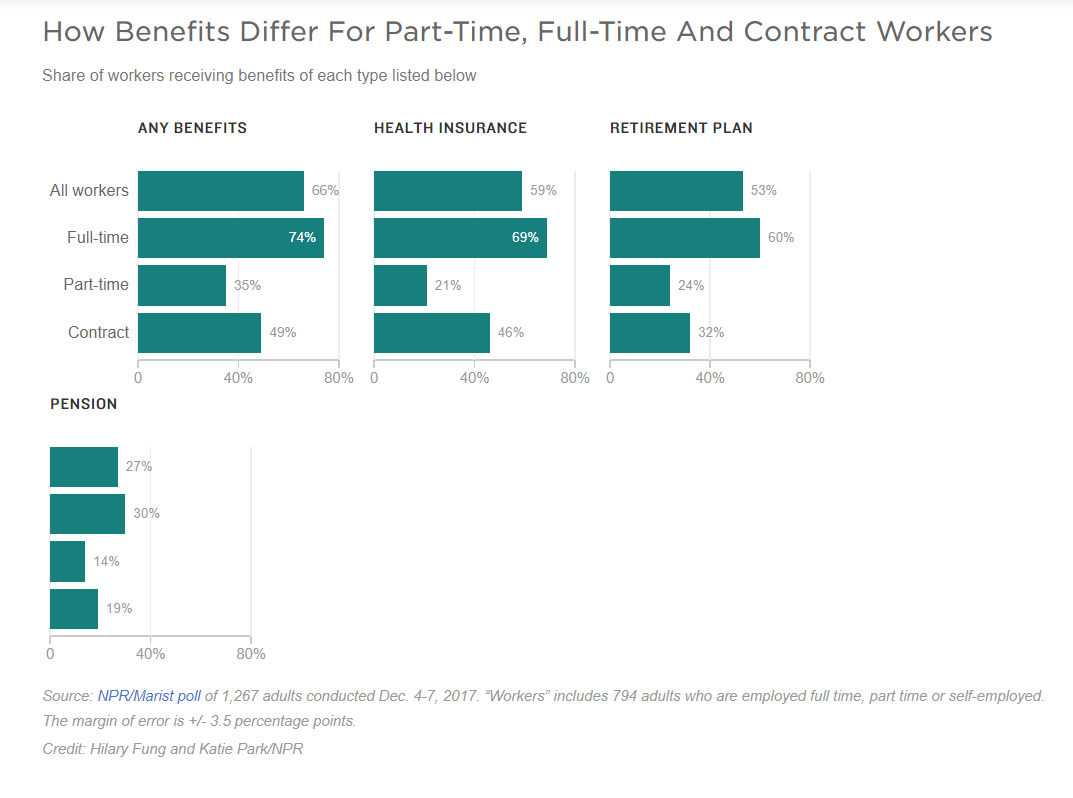

And this trend is expected to accelerate over the next decade. This “raises big questions about the future of the safety net,” the article said. “According to a [NPR/Marist] poll, 51 percent of freelance and contract workers do not receive benefits common to many full-time jobs — sick leave, unemployment insurance or retirement savings.”

As more entrepreneurs, small-business owners and contract workers find themselves lacking in benefits, it’ll be interesting to see what solutions come about to fill that gap.

Andie Burjek is a Workforce associate editor. Comment below or email editors@workforce.com.