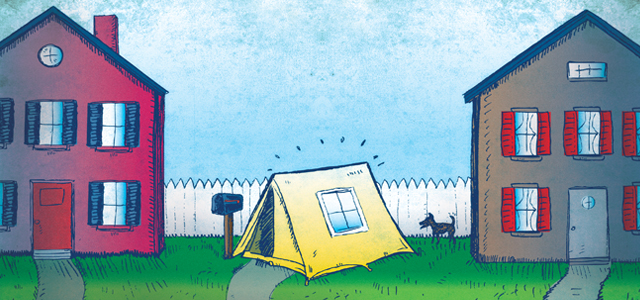

Since the financial meltdown hit and my retirement investments largely were blown to bits, I joke with my kids that they’d better buy a house on a big enough plot of land for me to comfortably locate my future digs. Nothing fancy, I tell them; enough room in the backyard for a refrigerator-size cardboard box works just fine.

The kids, God bless them, have grander visions for my golden years. “Dad, don’t be silly,” they tell me. “We’ll pitch a nice tent for you. It will be just like camping when we were little.”

Welcome to the new retirement reality, 2012.

Sure we joke about our days of gray, but unfortunately for a lot of boomers there’s more than a grain of truth to this modern-day gallows humor. According to a study last summer by Palo Alto, California-based investment advisers Financial Engines, nearly half of all boomers—those of us born between post-World War II and the early 1960s—fear that retirement will result in poverty.

Scarier still, an upcoming Aon Hewitt report reveals just 4 percent of employers feel “very confident” their workers will retire with enough money.

Many boomers who were laid off during the Great Recession still can’t find permanent work. Those of us lucky enough to hang onto our homes—we considered them our nest eggs, knowing a company-funded pension was not in our future—are largely under water, or if we’re lucky, barely have a chimney poking above.

Consider where we were just six years ago. As 2006 dawned, the sun was especially bright as our home values grew like kudzu. Investment portfolios—for many of us defined contribution plans like 401(k)s—happily followed suit. Birds chirped carefree tunes as the mailman delivered quarterly reports of double-digit returns. If a fund provided less than 10 percent, it was time to dump it and find another—heck, there were plenty that touted 20 percent returns.

Just a year later, however, gloom encompassed our bright little boomer future. The sky-high home values we used as ATMs to fund kitchen remodels and kids’ braces plummeted like rocks in a murky lake as the subprime mortgage crisis started sinking our retirement dream.

Later that year the Great Recession was officially under way and we boomers watched helplessly as the financial meltdown roared through the fall of 2008 like a Southern California wildfire. What remaining financial security offered by 401(k)s quickly went up in flames.

Within a year’s time, most every piece of financial advice imparted to us by our parents, financial counselors and anyone with an opinion was shredded. Owning a home—the American dream—was a financial mess. The values of save, save, save in a company-sponsored retirement plan might have been better served by burying cash in a coffee can in the backyard.

I recall a former colleague telling me he lost $50,000 in his retirement plans virtually overnight. On a journalist’s salary, that kind of loot takes a long time to accrue.

I would like to believe, three years past the depths of the worst economic time since the Great Depression, there are lessons learned.

Even though workers will still be tempted to do the coffee-can-in-the-backyard trick, there is wisdom in long-term stock investments. Employers must drive home that point.

The military has offered financial counseling for decades with great success. Service members also have benefited from financial incentives to advance their education.

I’m not sold on employees being automatically enrolled in employer-provided retirement programs. After all, I know my financial obligations better than my boss does. But it merits consideration, especially if the employer is matching an employee’s contribution.

Yes, the employee’s fruitful retirement is at stake, but so is the employer’s future. There is the so-called employee life cycle, and if the company expects to remain vibrant and relevant, the employer must maintain that circle of life. To pull a page from the Disney cartoon The Lion King, do you really want a befuddled, toothless, drooling Simba running your sales department?

And honestly, do I want to live in my kids’ backyard? Of course not.

But should that retirement money run out and I wind up scoping out a corner of the yard, I’m putting in for a five-man tent.

Rick Bell is Workforce Management’s managing editor. To comment email editors@workforce.com.

Workforce Management, February 2012, p. 34 — Subscribe Now!