Summary

-

Federal law does not require meal or rest breaks. – More

-

Some states have laws requiring meal and rest breaks – failing to comply can result in severe fines and even lawsuits.

-

Employers can reduce their risk exposure by automatically scheduling meal breaks and accurately applying missed break premium pay with the right software. – More

When it comes to rest and lunch breaks, managers often assume that a few minutes here and there will be insignificant.

However, this is simply not the case. Over the past several years, we’ve seen break-rule violations result in costly lawsuits.

In April 2022, an Oregon healthcare facility filed a lawsuit with the federal court system to overturn the state’s detailed meal and rest break rules. The facility is attempting to avoid nearly $100 million in fines due to persistent violations of employee meal and rest break rights dating back to 2015.

What’s confusing is that if this healthcare facility was in a different state, say Arkansas, these violations and fines would not exist.

Federal guidance on the subject of lunch breaks is slim to none – but state laws concerning paid and unpaid breaks vary.

It’s important to stay up-to-date on break rules in your state. While rest break rules can be convoluted, they are actually quite easy to comply with these days with the right payroll software and scheduling system in place.

Federal break laws

No federal law requires companies to offer breaks during work hours for meals or any other purpose.

However, according to the U.S. Department of Labor, federal law says that if a company chooses to allow break periods, any break under 20 minutes should be paid, and any over 30 minutes can be unpaid and classified as “off-the-clock.”

So, in essence, the federal government leaves it up to the employer. Rest breaks (under 20 minutes) are paid, and meal breaks (over 30 minutes) are unpaid. If a state has no laws regarding breaks, these federal standards automatically apply.

State break laws

It is up to the states to choose their own lunch and rest break laws. Some states default to the federal policy, while others have their own set of specific regulations to follow.

All meal and rest break laws only apply to non-exempt employees. Under federal law, exempt employees must earn at least $35,568 annually ($684/week) and meet certain duties tests, though many states have higher salary thresholds. For exempt employees, breaks are at the employer’s discretion.

Find your state below and click on it to see its break rules heading into 2026:

Alabama

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: 14-15-year-old employees who work more than 5 continuous hours get a 30-minute break.

Alabama defaults to federal law regarding breaks for workers aged 16+. If an employer chooses to provide a break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Alaska

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: Minors ages 14-17 who work 5+ consecutive hours get a 30-minute break.

Alaska defaults to federal law regarding breaks for workers aged 18 and over. If an employer chooses to provide a break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Arizona

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

Arizona defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Arkansas

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: Minors under 16 in the entertainment industry must receive a rest break if working more than 6 hours and a 12-hour rest break between shifts.

Arkansas defaults to federal law regarding breaks for workers of all ages. If an employer chooses to provide a break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than this do not need to be paid as long as the employee is completely relieved of all duties.

The state does have a special lactation break law. Employers must provide reasonable unpaid break time to employees who are lactating. These breaks must be taken in a private place close to their work area (not a bathroom stall).

California

Check out our in-depth breakdown of California’s employee break laws!

Meal Break:

Employees get a 30-minute unpaid meal break during a shift that is longer than five consecutive hours. If the employee is relieved of regular work duties and can leave the premises during their break, the break goes unpaid. But if these requirements are not met, the break must be paid at the regular rate of pay.

An employee may also waive their lunch break upon mutual consent with management if a workday will be completed in six hours or fewer.

If a work shift is longer than 10 hours, a second 30-minute rest break must be provided. If a total of 12 hours or fewer are worked in a day, this second meal break may be waived, but only if the first meal period was not waived. Employees who work longer than 15 hours get an additional third 30-minute break. If they work longer than 20 hours, they get a fourth 30-minute break.

If an employer fails to provide an employee a meal break during a shift, they owe the employee one extra hour of pay at the employee’s regular rate.

Rest Break:

Employees get a 10-minute paid rest break every 4 hours. A 10-minute break is not required for work time totaling less than three and a half hours.

Employees working in extreme weather conditions must also be provided with a five-minute “recovery period” in a protected environment in addition to their meal and rest break.

For every day an employee is forced to work through one or more of their rest breaks, their employer must pay them one additional hour of wages at the regular rate.

Minor Break:

Minors in non-entertainment industries follow the same meal and rest break rules as adults. Minors in the entertainment industry have additional protections, including age-based limits on worksite hours and dedicated time reserved for rest and recreation.

Colorado

Meal Break: 30 minutes for employees who work 5+ hours. If the break is “duty-free” it goes unpaid. However, if a “duty-free” meal is not possible, the employee may take an “on-duty” meal, in which case the employee must be paid.

Rest Break: 10 minutes paid per 4 hours worked

Minor Break: Minors follow the same meal and rest break rules as adults, though hour restrictions for minors under 16 may affect whether a meal break applies.

Connecticut

Meal Break: 30 minutes for non-exempt employees who work at least 7.5 hours. Employers are exempt from this requirement only if:

- Complying endangers public safety

- The duties of the position can only be done by one employee

- Fewer than five employees are working a shift in a particular location

- Operations require employees to be available to respond to urgent conditions

Rest Break: No state-mandated requirement

Minor Break: Same as adult employees; no additional requirement.

Delaware

Meal Break: Unpaid 30 minutes for employees 18+ who work at least 7.5 hours. Meal breaks must be given sometime after the first two hours of work and before the last two hours of work. Employers are exempt from this requirement only if:

- Complying endangers public safety

- The duties of the position can only be done by one employee

- Fewer than five employees are working a shift in a particular location

- Operations require employees to be available to respond to urgent conditions

- There exists a collective bargaining agreement that provides otherwise

- The employee is employed by a local school board to work directly with children

Rest Break: No state-mandated requirement.

Minor Break: 30 minutes for employees under 18 for every 5 consecutive hours of work.

Florida

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: 30-minute uninterrupted meal break required for employees under 18 who work more than 4 consecutive hours.

Florida defaults to federal law regarding breaks for workers aged 18 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Georgia

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

Georgia defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Hawaii

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: 30 minutes for 14 and 15-year-old employees who work five consecutive hours

Hawaii defaults to federal law regarding breaks for workers aged 16 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Idaho

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

Idaho defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Illinois

Meal Break: At least 20 minutes unpaid for employees who work 7.5+ continuous hours. Must be given no later than five hours after beginning work.

Rest Break: No state-mandated requirement

Minor Break: At least 30 minutes for minors working 5 or more consecutive hours

Indiana

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: 1-2 breaks totaling 30 minutes for employees under 18 who work at least six consecutive hours.

Indiana defaults to federal law regarding breaks for workers aged 18+. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Iowa

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: At least 30 minutes for employees under the age of 16 who work 5+ consecutive hours.

Iowa defaults to federal law regarding breaks for workers aged 16 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Kansas

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

Kansas defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Kentucky

Meal Break: Reasonable unpaid meal period (typically 30 minutes) for employees who work 5+ consecutive hours. Must be provided between the 3rd and 5th hour of work.

Rest Break: 10 minutes after every 4 hours of work.

Minor Break: Minors follow the same meal and rest break requirements as other employees.

Louisiana

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: At least 30 minutes unpaid for employees under 16 who work five consecutive hours

Louisiana defaults to federal law regarding breaks for workers aged 18 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Maine

Meal Break / Rest Break: 30-minute break for employees who work 6+ consecutive hours (may be unpaid if the employee is fully relieved of duties). Applies only where three or more employees are on duty, and certain exceptions (small workplace, emergencies, agreements) apply.

Minor Break: No separate state-mandated minor break beyond the general rule

Maryland

Meal Break: None for the majority of employees.

Exception: Under the Healthy Retail Employee Act, retail employers with 50+ employees operating 20+ weeks must provide breaks:

- 15-minute break for shifts of 4–6 hours (may be waived in writing)

- 30-minute break for shifts over 6 hours

- An additional 15-minute break for every 4 hours beyond 8 hours.

Rest Break (Non-retail employees): No general statewide requirement

Minor Break: 30 minutes for employees under 18 for every 5 consecutive hours of work

Massachusetts

Meal Break: 30-minute meal break required for employees who work more than 6 hours (may be unpaid if fully relieved of duties).

Rest Break: No state-mandated requirement

Minor Break: No separate state-mandated break requirement; general meal break law applies.

Michigan

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: 30-minute uninterrupted meal period required for employees under 18 who work more than 5 consecutive hours.

Michigan defaults to federal law regarding breaks for workers aged 18 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Minnesota

Meal Break: At least 30 minutes for employees who work 6+ consecutive hours (may be unpaid if the employee is fully relieved of duties)

Rest Break: At least 15 minutes paid (or enough time to use restroom, whichever is longer) within each 4 consecutive hours of work

Minor Break: No separate requirement; minors follow the same state meal and rest break rules as other employees

Mississippi

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

Mississippi defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Missouri

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No general state-mandated break requirement; limited industry-specific exceptions may apply (e.g. entertainment).

Missouri defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Montana

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

Montana defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Nebraska

At least 30 minutes per 8-hour shift for employees in assembling plants, workshops, or mechanical establishments; no general state requirement for other workplaces.

Rest Break: No state-mandated requirement

Minor Break: No separate state-mandated minor break requirement

Nevada

Meal Break: At least 30 minutes for employees working 8+ continuous hours.

Rest Break: At least 10 minutes paid every 4 hours. This break is not typically required if an employee’s total work time is less than three and a half hours.

Minor Break: No separate state-mandated break requirement; minors follow the same meal and rest break rules as other employees

New Hampshire

Meal Break: 30 minutes for employees who work 5+ consecutive hours.

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

New Jersey

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: At least 30 minutes for employees under 18 who work 5+ hours.

New Jersey defaults to federal law regarding breaks for workers aged 18 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

New Mexico

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: No state-mandated requirement

New Mexico defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

New York

Meal Break: 30 minutes for employees who work 6+ hours between 11 am and 2 pm. 45 minutes for employees midway through a 6+ hour shift that starts between 1 pm and 6 am. An additional 20 minutes between 5 pm and 7 pm for those working a shift starting before 11 am and continuing after 7 pm.

Different rules apply to factory workers. They get a 1-hour lunch period anywhere between 11 am and 2 pm for 6+ hour shifts or a 60-minute break midway through a shift of more than 6 hours that starts between 1 pm and 6 am.

Rest Break: No state-mandated short rest break requirement (e.g., no required 10- or 15-minute breaks)

Note: Note: New York also requires 24 consecutive hours of rest per calendar week in certain industries under the “Day of Rest” law. This is separate from daily rest breaks.

Minor Break: Minors follow the same meal break requirement.

North Carolina

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: At least 30 minutes for employees under 16 who work 5+ hour shifts.

North Carolina defaults to federal law regarding breaks for workers aged 16+. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

North Dakota

Meal Break: 30 minutes unpaid for employees who work 5+ hours when two or more employees are on duty.

Rest Break: No state-mandated requirement

Minor Break: Minors follow the same meal break requirement.

Ohio

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: At least 30 minutes unpaid for employees under 18 working five consecutive hours or more.

Ohio defaults to federal law regarding breaks for workers aged 18+. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Oklahoma

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: At least 30 minutes for every 5 hours worked and 1 hour for every 8 hours worked for employees under 16.

Oklahoma defaults to federal law regarding breaks for workers aged 16 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Oregon

Meal Break: At least 30 minutes, unpaid, uninterrupted, and relieved of all duties, must be provided per 6 hours worked. No meal break is required for shifts under 6 hours.

- 6-13 hours and 59 minutes: 1 break

- 14-21 hours and 59 minutes: 2 breaks

- 22-24 hours: 3 breaks

Rest Break: 10 minutes paid based on hours worked.

- 2-6 hours: 1 break

- 6 hours and 1 minute: 10 hours: 2 breaks

- 10 hours and 1 minute: 14 hours: 3 breaks

- 14 hours and 1 minute: 18 hours: 4 breaks

- 18 hours and 1 minute: 21 hours and 59 minutes: 5 breaks

- 22 hours 1 min – 24 hours: 6 breaks

Minor Break: Workers under 18 receive the same meal breaks as adults; however, it is required that they get 15-minute rest breaks rather than 10-minute breaks.

Pennsylvania

Meal Break: No state-mandated requirement

Rest Break: No state-mandated requirement

Minor Break: 30 minutes per 5 hours for workers under 18 years of age.

Pennsylvania defaults to federal law regarding breaks for workers aged 18 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Rhode Island

Meal Break: 20 minutes for employees who work 6 hours and 30 minutes for employees who work an 8-hour shift. The break may be unpaid if the employee is relieved of all duties.

Note: There are exceptions such as healthcare facilities and employers with fewer than three employees.

Rest Break: No state-mandated requirements

Minor Break: Minors follow the same meal break requirement.

South Carolina

Meal Break: No state-mandated requirements

Rest Break: No state-mandated requirements

Minor Break: No state-mandated requirements

South Carolina defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

South Dakota

Meal Break: No state-mandated requirements

Rest Break: No state-mandated requirements

Minor Break: No state-mandated requirements

South Dakota defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Tennessee

Meal Break: At least 30 minutes for employees who work 6+ hours

Rest Break: No state-mandated requirements

Minor Break: 30-minute unpaid meal period required for employees under 18 who are scheduled to work six consecutive hours

Texas

Meal Break: No state-mandated requirements

Rest Break: No state-mandated requirements

Minor Break: No state-mandated requirements

Texas defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Utah

Meal Break: No state-mandated requirements

Rest Break: No state-mandated requirements

Minor Break: At least 30 minutes for lunch no later than 5 hours into the workday for employees under 18. They must also be given a 10-minute rest break for every 4 hours worked and cannot work 3+ consecutive hours without a 10-minute break.

Utah defaults to federal law regarding breaks for workers aged 18 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Vermont

Meal Break: Employees must have a “reasonable opportunity” to eat and use the restroom. This opportunity must be paid if it is less than 20 minutes.

Rest Break: No state-mandated requirements

Minor Break: No state-mandated requirements

Vermont has a special lactation break law requiring employers to provide reasonable break time throughout the day to employees who are lactating. It is left to the employer’s discretion whether these breaks are paid or unpaid unless denoted by a collective bargaining agreement.

Virginia

Meal Break: No state-mandated requirements

Rest Break: No state-mandated requirements

Minor Break: At least 30 minutes for employees under 16 who work 5+ consecutive hours.

Virginia defaults to federal law regarding breaks for workers aged 16 and over. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Washington

Meal Break: 30-minute unpaid meal period required when working more than 5 consecutive hours. Must be given between 2 and 5 hours from the start of the shift. An additional 30-minute meal period is required if working 3+ hours beyond the scheduled shift.

Rest Break: At least 10 minutes for every 4 hours worked

Minor Break:

Ages 14–15: 30-minute meal break after no more than 4 consecutive hours; 10-minute paid rest break every 2 hours; may not work more than 2 consecutive hours without a rest break.

Ages 16–17: 30-minute meal break when working more than 5 consecutive hours (given between 2–5 hours from shift start); 10-minute paid rest break every 4 hours; may not work more than 3 consecutive hours without a rest break.

West Virginia

Meal Break: 20 minutes for employees who work 6+ hours.

Rest Break: No state-mandated requirements

Minor Break: For employees under 16, a 30-minute lunch break is required for work periods exceeding five consecutive hours.

Wisconsin

Meal Break: No state-mandated requirements

Rest Break: No state-mandated requirements

Minor Break: 30 minutes duty-free for employees under 18 working 6 consecutive hours. 16 and 17-year-olds must have 8 hours of rest between shifts if scheduled after 8 pm.

Wisconsin defaults to federal law regarding breaks for workers aged 18+. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid as long as the employee is completely relieved of all duties.

Wyoming

Meal Break: No state-mandated requirements

Rest Break: No state-mandated requirements

Minor Break: No state-mandated requirements

Wyoming defaults to federal law regarding breaks for all workers. If an employer chooses to provide a meal break, it must be paid only if it lasts less than 20 minutes. Breaks lasting longer than 30 minutes are classified as meal periods and do not need to be paid, as long as the employee is completely relieved of all duties.

Meal vs. rest breaks

The main difference between a meal and a rest break is often its length. The typical meal break is 20-30 minutes and must be taken around midday, while a rest break is usually anywhere between 10-15 minutes and occurs at regular intervals throughout a shift.

As with lunch breaks, no federal labor law requires short breaks at work. Only a small number of states have local laws requiring employers to offer rest periods during work hours, and these short breaks almost always come in addition to a meal break. For instance, Colorado requires a 30-minute meal break when an employee works more than five consecutive hours, along with a 10-minute paid rest break for every four hours worked (or major fraction thereof).

Sometimes, however, it’s all just semantics.

Take Maine, for example. The Pine Tree State is the only one of these 11 states that does not have a “meal break” per see, but it does have a rest break, requiring 30 minutes for work periods of over six hours. Technically, it’s not a meal break, just a rest break, but you and I both know it’s used for lunch.

Minors and break laws

State laws typically afford minors greater break protections than adult employees. While most state meal break rules for adults automatically cover minors, some states impose stricter standards for those under 18. Delaware, for example, requires a 30-minute meal break for adults who work seven and a half hours, but minors must receive the same break after only five consecutive hours.

Some states that do not require meal or rest breaks for adult employees impose separate break requirements for minors. For instance, Louisiana requires employers to provide a 30-minute break to employees under 16 who work five consecutive hours, and Michigan requires a 30-minute break for employees under 18 who work more than five consecutive hours. In Hawaii, a similar five-hour rule applies only to 14- and 15-year-olds.

Managing rest and meal breaks

If your state has specific rest break requirements, it’s essential that management understands them and takes appropriate action to uphold them. Of course, this is sometimes easier said than done.

Without the right protocols and tools, tracking breaks can be challenging, especially in complicated states like California, Oregon, and New York. Luckily, there are many ways to automate the workload.

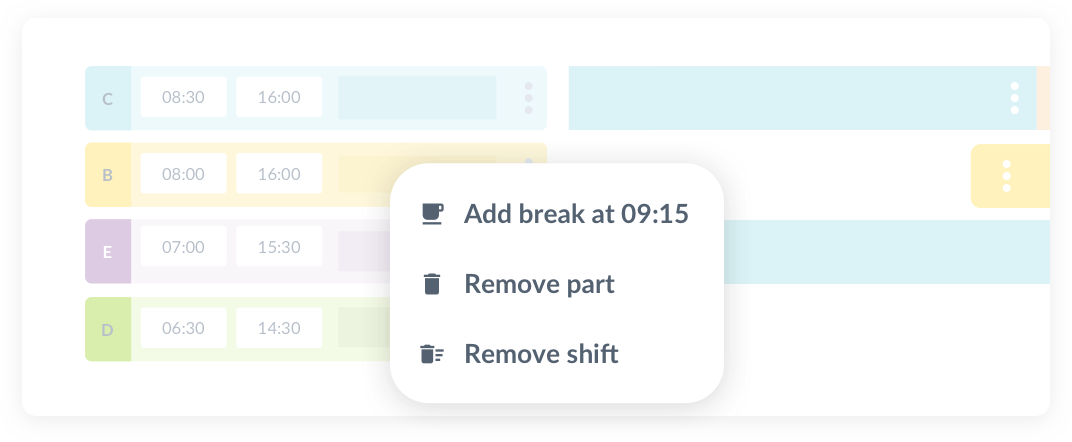

An online employee scheduling and time tracking platform like Workforce.com helps you manage break scheduling and missed break payments, reducing your risk of expensive missed break lawsuits. Here are a few specific ways the cloud-based system helps you plan lunch breaks and calculate compensation accurately:

Auto-schedule compliant breaks

Workforce.com’s scheduling allows managers to automatically apply compliant meal and rest breaks to employee schedules according to local state laws. Employees can easily view these breaks from their phones, knowing exactly when to work and rest.

Accurately pay missed break premiums

Using classification tags designed to handle California’s complex requirements, Workforce.com’s payroll system automatically flags when an employee misses a break and applies the correct premium pay to their timesheet. This ensures you’ll never underpay a staff member for a missed break again.

Track breaks in real-time

Via a time clock app, managers can see who’s working, who’s not, and who’s on break—all in one place and in real-time. This frontline visibility helps managers respond more quickly to lunch break non-compliance.

Utilize timesheet attestations

Managers can create conditional questions that appear whenever an employee clocks out of a shift. These questions may ask things like “Did you waive your break?” or “Did you take your break?” depending on the length of the shift. Answers will automatically add all necessary premiums and allowances to timesheets, ensuring employees are always paid accurately. These answers will also create a paper trail of agreed-upon waived breaks, protecting you from potential lawsuits.

Manage break rules across state lines

Workforce.com has robust team and location functionality, letting you set up multiple locations on the platform. Break rules at each location can be configured according to local state laws, ensuring chains stay organized no matter where they are in the country.

Support staff and protect your business with better breaks

There are two key things managers can do right now to ensure their business stays on the right side of the law. One is to understand and adhere to whatever legislation applies in your state. The other is to be clear about what breaks are allowed, encourage staff to use them, and ensure they are accurately recorded.

Doing all of this manually is a huge task and prone to human error. Instead, use employee scheduling software to automate how breaks are administered. Pair it with a specialized payroll system to quickly apply correct premium payments for missed breaks, and you’ll reduce your risk exposure tremendously.

Sound intriguing? Get in touch with us today, let’s talk about it.

But getting break times right doesn’t just reduce your risk exposure – it also makes for happier employees.

Shift workers deserve their breaks. Routinely taking time during a shift to eat, rest, and recharge always helps productivity and, most importantly, mental health.

Discover five more ways to boost employee mental health by tuning in to our free webinar below:

Webinar: 5 Ways to Offer Mental Health Support for Hourly Staff

This information is for general purposes only and should not be considered legal advice. While we strive to keep it updated, labor laws and regulations can change at any time. It’s always a good idea to consult with a legal professional or relevant authorities to comply with the most current standards.