Summary

- Employee scheduling is more than just filling shifts. It’s about balancing profitability with employee experience.

- Labor laws govern schedules in some cities and states, which can pose compliance issues for large hourly teams.

- Employee scheduling software can streamline shift assignments, but truly efficient systems can also factor in demand and compliance when managers fill shifts.

Creating and managing an employee schedule is a complex process that can take up hours out of a manager’s week.

Yet employee scheduling can have massive impacts on a business, especially for organizations with a large hourly workforce and significant labor costs.

Poor scheduling can lead to overstaffing, which inflates labor expenses, or understaffing, which strains employees and impacts productivity. An unpredictable schedule can also contribute to burnout and high turnover, forcing you to constantly recruit and train new members.

Many factors go into the scheduling process and creating the most effective schedule, including having the right expertise on your team, communicating with your frontline staff, and using the right employee scheduling software.

Here’s exactly how to schedule employees effectively.

1. Understand the laws that govern schedules in your city or state

Scheduling employees effectively, at its most basic level, requires compliance with labor laws.

Over the past decade, different cities and states have passed their own predictable scheduling laws regulating shift work, starting with San Francisco in 2013. See if you are in a jurisdiction with predictive scheduling laws here.

Depending on the specific law, employers may have to schedule employees up to two weeks in advance. Further, these laws may levy employer penalties for unexpected employee work schedule changes, regulate “clopening” shifts, and define schedule recordkeeping requirements for business owners.

These laws address the challenges many hourly workers face, including unpredictable, unstable, and insufficient hours. Certain staff scheduling practices, like on-call scheduling, make it difficult for employees to hold second jobs or plan for other responsibilities in advance.

However, employers may find it difficult to make last-minute scheduling decisions given the perceived lack of flexibility the laws impose on them.

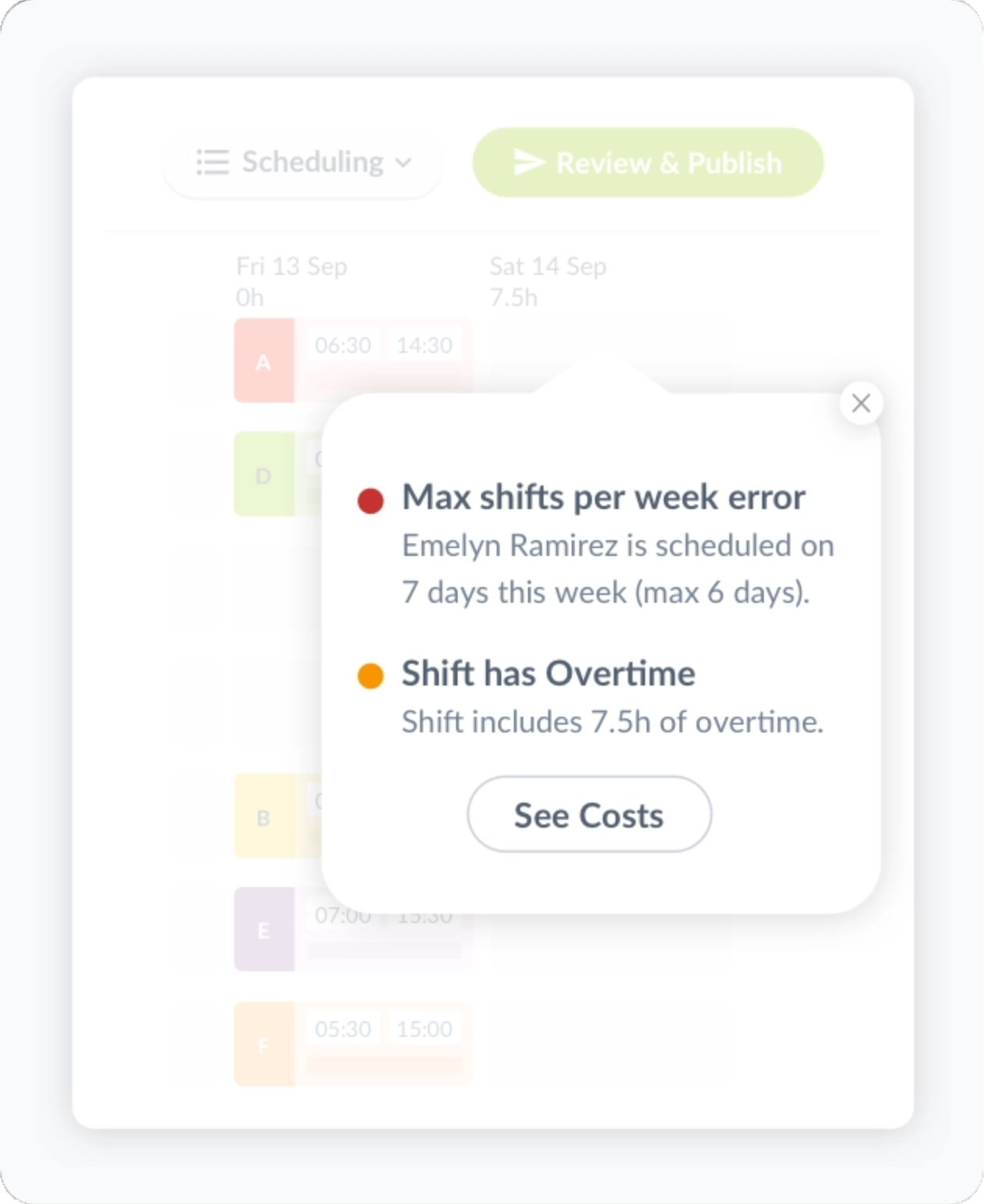

Here’s where employee scheduling software like Workforce.com can help. Beyond tracking employee attendance and reliably scheduling employees in advance, it’s kept up-to-date with legal rules and regulations. Plus, managers can set their own employee scheduling rules.

The software notifies managers if they’re about to break a law or rule when placing people in open shifts, scheduling staff beyond their maximum hours, assigning minor workers for hours they are not allowed to work, or under other conditions for which they would be at risk of non-compliance with the rules.

2. Use labor forecasting to create optimal schedules

Labor forecasting is a powerful tool in employee scheduling.

Two main types of data go into these predictions. There’s data on external factors like the time of year, weather, or events happening nearby. Then, there’s data on your specific business’s conditions and operations, such as your historical sales data, booked appointments, busiest times, foot traffic, and employee availability.

While no prediction is 100 percent certain, the more accurate and relevant data you connect with labor forecasting, the more confident you can be in your forecasts and identifying scheduling needs, reducing your chances of overstaffing, understaffing, and incurring unnecessary overtime.

Workforce.com’s labor forecasting system factors in all the relevant data, both internal and external, to calculate staffing ratios that will equip managers to create the most productive schedule, ensuring that you have the optimal number of employees in every shift.

Imagine you run a retail business and intend to optimize your staff scheduling throughout the year. With labor forecasting, you can analyze past sales trends and customer traffic to predict busy and slow periods. For instance, if your data shows that holiday shopping spikes in November and December, you can plan ahead and hire seasonal and part-time employees to help with the increased demand. On the other hand, if January tends to be slow, you can scale back part-time hours to control labor costs and avoid overstaffing.

3. Match the right employees to the right shifts

Filling open shifts is complicated beyond just legal compliance and predicting business needs. Employees have different preferences and limitations, while managers aim to assign shifts fairly and efficiently. The challenge? Creating a schedule that works for both the business and its people.

Using a combination of scheduling algorithms and employee input for filling schedules can be a good strategy. This allows a business to benefit from advances in technology while also taking real-world human considerations into account.

So, how do you do that exactly?

First, let’s look at the facts. Before assigning shifts, ensure employees meet the necessary qualifications. Does a role require specific certifications? Is there a minimum age requirement? Workforce.com simplifies this by sending managers real-time notifications, helping them assign shifts only to qualified team members.

Next, factor in employee preferences. Employees can submit feedback through Workforce.com’s shift rating and feedback, sharing insights on staffing levels, engagement, and management after each shift. By analyzing this feedback, managers can build schedules that align with business objectives and employee preferences.

Using these insights, you can also make less desirable shifts more appealing, especially if you’re operating 24/7. Late nights, early mornings, and weekend shifts can be more challenging to fill. To encourage coverage, consider offering shift deferential pay for employees who would take on these odd hours.

4. Plan ahead for last-minute scheduling changes

Unexpected absences can happen, but they don’t have to disrupt your operations. A reliable shift swapping or replacement system ensures you can quickly fill gaps caused by no-shows or last-minute call-outs.

Managers can use Workforce.com to reassign vacant shifts. Available and qualified employees can claim open shifts, either through a manager’s direct offer or a system-wide notification. Depending on your settings, employees can trade shifts and have those changes automatically apply to schedules or with manager approval for added control.

5. Apply automation to reduce admin work and avoid scheduling conflicts

Employee scheduling goes beyond assigning team members to shifts. It requires balancing different, and without a proper system in place, it’s easy for things to slip through the cracks.

Beyond operating hours and number of staff members, managers also need to to look at time-off requests, employee classifications, labor forecasts, and compliance requirements. Ensuring all of these factors align each work week is challenging, but Workforce.com’s scheduling app simplifies the process.

With Workforce.com’s scheduling tool, creating schedules will not be as time-consuming. It offers powerful functionality to speed up the process. For instance, recurring work schedules can be saved as schedule templates. Instead of creating schedules from scratch, you can simply copy, paste, and adjust the templates as needed, saving you time and minimizing errors.

6. Actively reassess and adapt

The common thread running through these steps is that nothing about employee scheduling is static.

Laws change, individual employees may become more or less productive over time, and the most efficient ones may leave if they’re not getting sufficient hours or good shifts.

Continually use the resources and data you have to understand what’s successful on your front line. The same old employee shift scheduling patterns might stop working over time. And your employees’ needs and levels of engagement will change. Effective employee scheduling requires that you’re aware of these developments and adapt to them.

Going beyond employee scheduling

Employee scheduling is significant, but true workforce success goes far beyond just filling shifts. Managing an hourly team requires integration between scheduling, time and attendance tracking, hiring and retention, and payroll.

That’s where Workforce.com comes in.

With Workforce.com, you don’t just schedule shifts. You hire the right talent, track time accurately, schedule employees strategically, and ensure accurate, on-time payroll. Everything is housed in one unified system, giving you a single source of truth for workforce management and HR.

Workforce.com has transformed employee scheduling, HR, and payroll worldwide. But don’t take our word for it—see it for yourself by booking a demo today.