Summary

- The first paycheck is crucial to employee engagement and can make or break employee onboarding for new hires.

- Processing the first paycheck begins before a new employee’s first day at work, and much of it involves gathering the necessary information.

- With the right payroll system, you can cut down time spent on approving timesheets and payroll processing by 95%.

Many things can make or break a new hire’s experience, and one of them is how they receive their first paycheck. Get it right, and you set the tone for a smooth, professional experience. Get it wrong, and you risk confusion, frustration, and a shaky start.

So, what’s the big deal with payroll? Isn’t it just a routine process? In theory, yes. But in practice, it’s anything but simple and can be time-consuming, especially for hourly teams. First runs are where small mistakes can snowball: missing information, misclassified roles, and incorrect tax setup.

Successful payroll starts long before day one. It’s about having the right systems in place, from collecting forms to tracking hours, so that everything flows naturally from onboarding to payday.

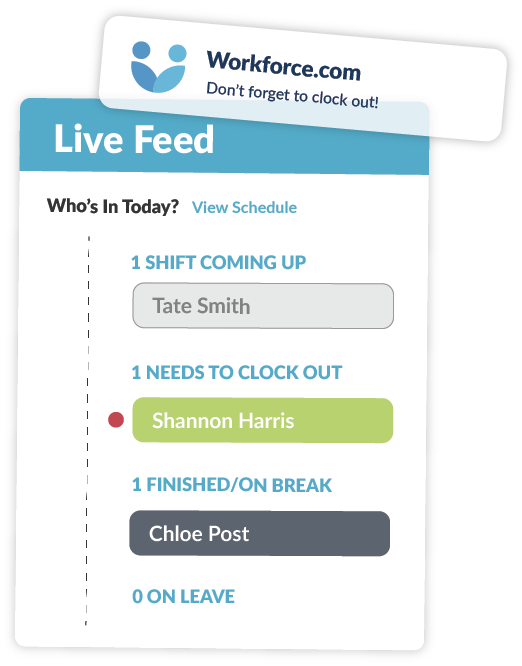

That’s where Workforce.com can help. It connects onboarding, scheduling, timesheets, and payroll in a single system. It keeps everything in sync so you never have to chase information, avoid duplicate data entry, eliminate costly errors, and dodge any surprises come payday.

It provides a simple workflow that makes payroll easy for payroll teams and stress-free for new hires.

Let’s take a closer look at how it works:

Get crucial payroll information before the first day

Smooth payroll management starts with onboarding, which begins before your new hire even clocks in.

While onboarding often focuses on culture, policies, and setting expectations, the administrative side is just as important, especially when it comes to payroll. This is where you gather key details such as tax documents, bank account info, and employee data and set job classifications and pay rates. If you go about this manually, you’re opening the door to delays, data entry mistakes, and miscalculations when processing payroll. Something as small as a missing form can derail a first paycheck.

Workforce.com makes onboarding fully digital. New hires enter their own employee information directly into the system. No double-entry or unnecessary paperwork. Tax forms, direct deposit details, and personal data all sync instantly with payroll.

If details are missing, managers are alerted and ensure that the required information is lodged before payday or even a new hire’s first day.

Pro tip: Start onboarding as soon as the offer’s signed, not the first day on the job.

Also read: Creating a Better Onboarding Process for Hourly Staff

Download Free Template: Employee Onboarding Checklist

Set up pay rates and classifications in one place

Misclassification is a significant cause of payroll errors. For new hires, it’s essential that employers set this up correctly the first time.

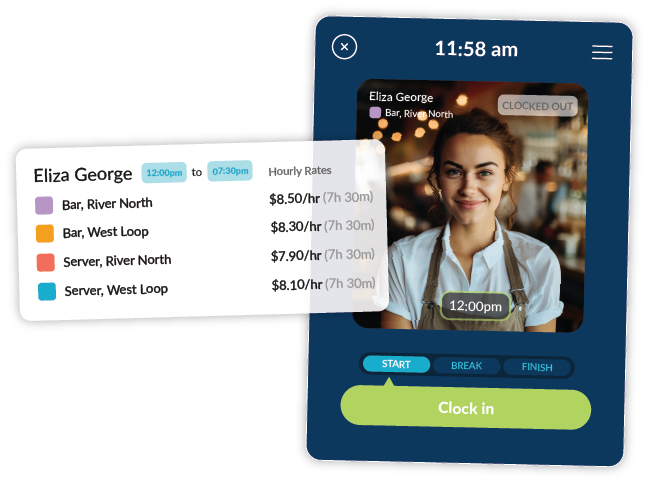

With Workforce.com, everything lives in one place. You can assign pay rates, overtime rules, and employee classifications in a single system. You can also customize payroll data if needed, especially for more complicated work structures, such as employees taking up shifts at different sites or working two different roles with varying pay rates.

Need to make a change down the line? Update the info in one place, and it’s reflected instantly across schedules and payroll.

In addition, business owners get proactive tools that help catch issues before they become problems and minimize the administrative burden. Workforce.com shows how much each shift will cost as schedules are built, so there are no surprises during payroll processing. If an employee is about to be scheduled overtime, the system flags it immediately, giving you a chance to review it. It also alerts you if a rest break hasn’t been scheduled, helping you avoid compliance issues, additional payouts or violations.

Track accurate employee hours

Payroll mistakes often come from incorrect or incomplete timesheets. It can be tricky, especially if the employee joined in the middle of a pay period.

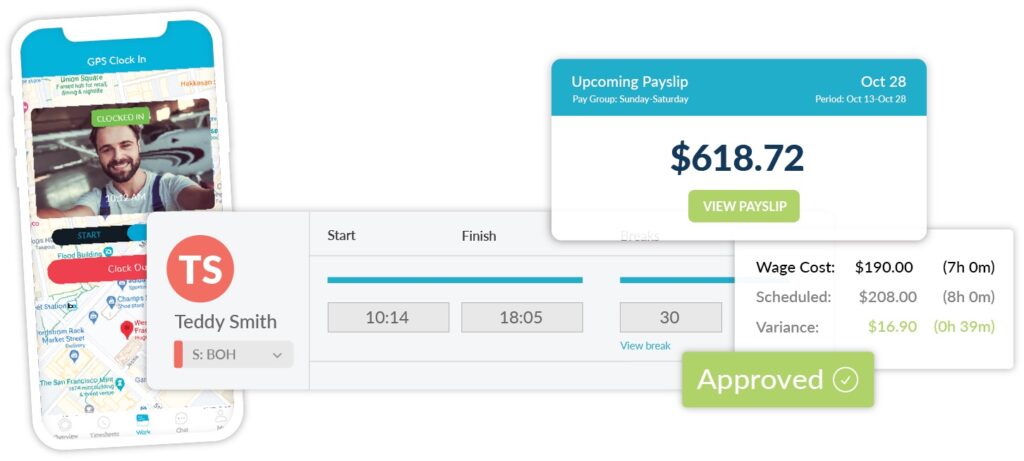

Workforce.com streamlines time tracking. Employees clock in and out through a mobile app (either on their phones or a device set up in the workplace), and their hours are instantly captured and fed into digital timesheets; no manual data entry is required. Both managers and employees can view and verify timesheets at any time, making it easy to catch and correct discrepancies early.

Also read: What is employee self-service? [Guide]

Missed a clock-in? The system alerts managers in real-time, so they can check in with staff and make quick corrections well before payroll is due. You’ll also get notifications for potential overtime or missed breaks, helping you stay compliant and avoid unplanned costs.

You’ll never have to ask, “Did we get their hours in correctly?” because you know you do. You can spot issues mid-cycle, not the eleventh hour, so payroll runs smoothly.

Automate deductions and tax withholdings with payroll software

Accurate payroll and clear pay breakdowns build trust from day one. But without the right system, deductions can be easily miscalculated, especially with an hourly team.

Workforce.com’s payroll solution provides automation and takes the guesswork out of managing every type of deduction. Mandatory payroll taxes and withholdings, like federal, state, and local taxes, are automatically applied based on W-4 data collected during onboarding. Pre-tax and post-tax deductions are just as easy to configure. Employees receive automatically generated pay stubs with a clear breakdown of their gross pay, deductions, and take-home pay.

Also read: What are different payroll deductions? Taxes, benefits, and more

Download free template: Payroll Deduction Authorization Form

Pre-approve data and preview pay summaries

Payroll becomes stressful when pay information is inaccurate or when it’s verified too late in the process. Workforce.com helps you stay ahead by reviewing and approving data as it comes in. As shifts wrap up, you can instantly verify timesheets, check for missing logs, and receive alerts for anything that needs your attention so that nothing slips through the cracks.

You’ll also get a clear, intuitive payroll preview that highlights exactly what’s ready to go and what still needs fixing. Because everything—scheduling, timesheets, pay rates, and deductions—lives in one system, resolving discrepancies is fast and straightforward. No switching between platforms. No chasing down spreadsheets.

Get payroll processing right from day one

The first paycheck isn’t just about getting paid. It’s a crucial moment in the new hire experience. It shows whether your business is organized or not. New employees notice and payroll is one of the clearest indicators of whether you’ve got your systems together.

That’s why an all-in-one platform matters. Shipley Do-Nuts learned this firsthand when they switched to Workforce.com. Before, they were juggling four separate systems: one for onboarding, another for clock-ins, a third for scheduling, and a fourth for running payroll.

“Integrating all of those together has saved us so much time. It takes me about 95% less time than before, Shelly Archer, Human Resources Manager at Shipley Do-Nuts, shares.

Want to see how Workforce.com works? Learn more about Shipley Do-Nuts’ success with Workforce.com, or book a demo today.

Predictive scheduling laws across the United States

Predictive scheduling laws across the United States