Summary:

- Hourly teams in the U.S. will face both new and familiar challenges in 2026, and the companies that lead will be those that understand their operational needs and invest in solutions that keep them competitive.

- AI will continue to dominate conversations, but the real advantage will come from using it effectively, not just adopting it.

- Automation and the push to eliminate manual processes will accelerate, with organizations seeking tools that do the work rather than just support it.

- A true all-in-one platform can help hourly workforces stay ahead, bridging gaps across compliance, payroll, and workforce operations.

Hourly teams across the United States are heading into 2026 facing long-standing challenges and emerging trends. The labor market remains tight, compliance keeps getting tougher, and the frontline workforce is transforming faster than most organizations can keep up.

As of late 2025, the U.S. civilian labor force participation rate is hovering around 62-63%, still below pre-pandemic norms. The gap underscores how hard it remains to attract and retain top talent, even as labor costs are rising. More than 20 states raised their minimum wages in 2025 alone, with further increases scheduled for 2026 and beyond.

At the same time, technology continues to reshape how hourly work is managed. In 2026, the competitive edge will go to organizations implementing smarter technology that doesn’t just support work but actually does the work. We’re talking about systems that not only handle administrative tasks but also take action based on different data and insights.

In 2026, the winners won’t be the ones chasing shiny trends. They will be those who move faster than regulatory changes, adapt quickly to new technologies, embrace challenges, and configure their systems to keep pace with existing trends and stay ahead of new ones.

Below are five HR and payroll trends hourly teams should expect and prepare for as 2026 unfolds.

Companies effectively using AI will stay ahead in 2026.

And no, this is not simply adopting AI. It is about using AI in ways that actually move the business forward.

While AI investment continues to surge, very few companies feel confident about how they use it. In fact, a study found that only 1 percent of organizations believe they are implementing AI sufficiently to deliver substantial business outcomes. The gap between using AI and using it well is becoming one of the most significant competitive divides heading into 2026.

Over the past year, we have already seen AI take deeper root in HR and workforce management. Adoption has grown steadily throughout 2025, especially in areas like hiring and recruitment. More organizations are recognizing how AI can support critical operational processes, including labor forecasting and demand-based scheduling.

“One of the great value propositions of Workforce.com is to optimize staffing levels, which can have tremendous savings for employers and fewer headaches for employees. AI has been a tremendous tool in that product,” shares Craig Chval, Vice President of Product at Workforce.com.

Workforce.com adopted AI early and applied it directly to labor forecasting. By analyzing factors such as historical sales, booked appointments, local events, and even weather patterns, the platform can determine how many employees should be on shift on any given day. The result is better staffing accuracy, stronger margins, and more consistent service.

But forecasting is just one part of it. AI is now helping customers in broader operational areas as well. “AI continues to be the biggest shift in this space. It provides customers clear visibility into how compliance rules are applied, rather than relying on calculations that are hard to interpret. It also helps surface risks early, such as warning when schedules break minor hours or when patterns may trigger a Fair Workweek obligation,” explains Travis Kohlmeyer, General Manager at Workforce.com.

AI is still a buzzword for a reason. But it is no longer a matter of whether organizations should use it. We are well past that point. The businesses pulling ahead today are the ones using AI to streamline their operations and solve real pain points. For hourly teams, the key is applying AI with focus and purpose. That means choosing use cases that matter rather than broad, unfocused applications that do not actually help the business run better.

Compliance becomes central to payroll software buying decisions.

Hourly teams are increasingly recognizing that payroll software needs to do more than generate payslips.

For organizations with shift-based workforces, payroll is inherently complex because no two pay cycles look the same. Hours fluctuate, roles change, and even small scheduling differences can significantly affect what an employee earns.

“Often, organizations don’t realize that some of the really big names in payroll systems actually lack the compliance capability for so many different work rules,” Travis explains. “Break compliance, minor working hour rules, and Fair Workweek are the most we see miscalculated on some platforms.”

Payroll for hourly teams is not about assigning a pay rate and expecting the platform to handle the rest. Every pay period carries its own variables: different schedules, shift changes, varying roles or departments, premiums, and overlapping rules. This is why businesses must understand how their current payroll system handles these scenarios, or whether it handles them at all.

Workforce.com is built to manage this complexity from the ground up. The platform focuses deeply on how work rules and pay rules operate together. “We treat compliance as a design constraint, and not merely a patch. That means more robust rule engines, better guardrails in scheduling, and clearer auditability,” Travis adds.

Compliance may be complicated, but it is manageable with a payroll platform designed to understand the real-world scenarios that create risk. This includes minor laws, multi-role staff, split shifts, overlapping rules, and complex premium structures. With federal, state, and city-level regulations expected to continue evolving, organizations will increasingly look for payroll systems that anticipate these changes and help keep them ahead of costly mistakes.

Many will switch to all-in-one platforms to eliminate manual processes.

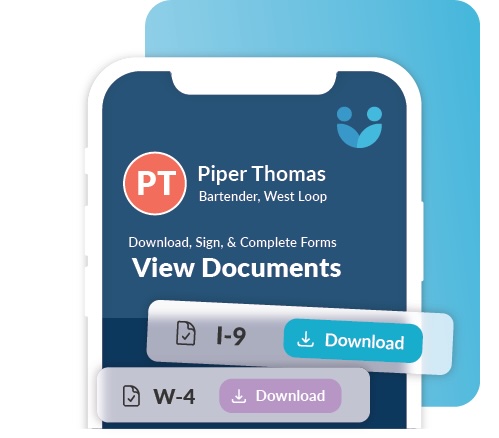

Many organizations are moving toward all-in-one platforms to eliminate manual processes and reduce complexity. But a genuine all-in-one solution is more than a collection of loosely stitched-together apps. It is a single ecosystem where scheduling, time tracking, HR, payroll, and other workflows all operate in one place. We have seen growing demand for this throughout 2025, and we expect it to become an even stronger priority in 2026 and beyond.

“Oftentimes, potential clients look for help to eliminate manual processes such as spreadsheet scheduling, outdated time tracking, and the disconnect between systems they use,” shares Joseph Cuellar, Enterprise Account Executive at Workforce.com.

Ray Chan, Head of Customer Support at Workforce.com, adds, “What we have seen as the biggest trend for prospective clients looking into our system is platform consolidation. Many organizations still use separate systems for scheduling, timesheets, payroll, HR, ATS, and more. A solution that spans the entire employee lifecycle is a major attraction.”

The motivation is simple. Organizations want to stop switching between multiple platforms to complete basic tasks. Not only is this tedious, but it introduces errors and forces teams to spend additional time double-checking data that should flow automatically.

Third Space Brewing is one of many organizations that have seen the benefits of consolidating onto Workforce.com. “It is the ability to do everything under one roof and not have to import and export data out from separate pieces of software,” says John Wynne, Taproom GM at Third Space Brewing.

Scott Passolt, Third Space Brewing’s Controller, expands on this, saying, “We definitely saved time from not having to reconcile numbers between two different platforms all the time. Everything flows easily. If we know the timesheets are correct, we know payroll is correct. I have more confidence in the accuracy of the numbers. It has given us peace of mind because we are no longer worried about missing something when moving data between systems.”

Watch: How Third Space Brewing Tapped into Better Payroll and Workforce Management

As organizations look ahead to 2026, especially those operating large hourly workforces, the demand for a unified, all-in-one platform will only continue to grow.

“All-in-one products are the future of the industry, and we are fully committed to that vision,” Craig shares. “Having an integrated, all-in-one solution eliminates so many pain points for our customers, and it is no surprise that the industry is moving in that direction. Our product roadmap is laser-focused on eliminating the need for customers to juggle a host of different services and offerings.

Hourly work is evolving, especially around pay.

Hourly work is changing, and pay is becoming one of the clearest areas of transformation. In 2026, more hourly workers will expect faster, more flexible access to their earnings, rather than waiting for a traditional biweekly cycle.

We are already seeing strong demand for on-demand pay, along with greater clarity and transparency around how compensation is calculated. In response, employers are beginning to look for technology that can keep pace with modern work patterns and move beyond the rigid pay structures built decades ago.

This year, several states and localities introduced or strengthened pay transparency requirements, and similar movements are expected to continue into 2026. These changes reflect a broader shift in expectations: employees want easy, direct insight into how their pay works, and employers are increasingly required to provide it.

Hourly workers should not have to jump through hoops to understand or access their wages. The right technology can make this simple by giving them clear visibility into their pay, the factors that influence their net earnings, and how each calculation is made. As transparency and flexibility become standard expectations, having modern, employee-friendly pay tools will become essential for hourly teams.

Demand grows for automations that do the work, rather than just support it.

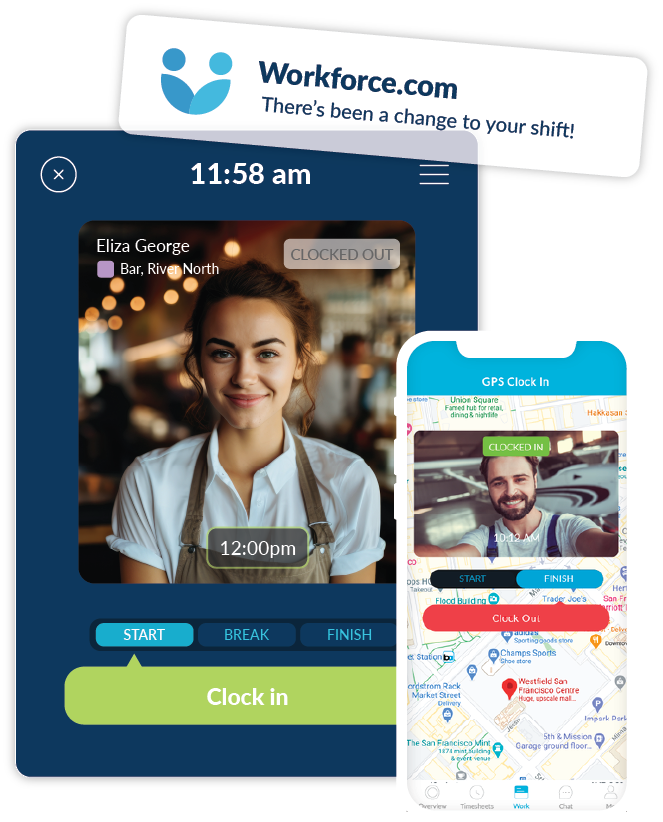

More teams will expect automations and built-in intelligence in the software they adopt. Technology has always aimed to reduce administrative workload, but in 2026, we will see organizations push beyond that. They will want automations that fully execute tasks, not just assist with them.

“Customers increasingly want tools that remove work, not just organize it,” Travis says. “They continue to seek hands-off scheduling, such as automatic shift building and demand-based scheduling. We are also seeing customers shift away from platforms that simply give them data. Instead, they want tools that make decisions and explain the reasoning behind them. And as compliance concerns rise, more organizations are adopting automated compliance interpretations as well.”

This shift is becoming more pronounced as many organizations operate with leaner teams. With fewer staff, they cannot afford tools that only support work. They need platforms that actively handle tasks and keep processes moving. In 2026, the demand for true hands-off automation will only grow stronger.

Industry Focus: Family Entertainment Centers (FEC)

Family entertainment centers (FECs) offer a clear snapshot of the challenges that hourly work businesses face today. FECs sit at the intersection of hospitality, retail, and events, all sectors with highly variable hourly staffing and tight compliance requirements. This makes them a strong indicator of the trends shaping HR and payroll across many other industries.

FECs deal with unpredictable demand swings driven by weather, school calendars, weekends, and special events. Their staff often work across multiple roles in a single week, sometimes in a single day. And because many employees are minors, managers must navigate some of the strictest labor rules in the country, with specific limits on scheduling, breaks, and total hours worked.

Navigating all of that makes technology essential. Bria Stuckey, the General Manager of Altitude Trampoline Park, explains how technology can help FECs overcome operational challenges.

For Bria, compliance with minor labor laws is one of the most significant pressure points. She notes that the right system helps her avoid mistakes before they happen. “Most of my team is between 15 and 17, so we have to follow strict hour limits. Workforce.com helps me stay compliant with those labor laws. If a minor cannot be scheduled, it tells me and will not let me schedule them. I do not have to go back and fix mistakes. It keeps us compliant from the start.”

Beyond compliance, FEC operators also need tools that let them focus on their guests rather than administrative issues. Bria explains that when something goes wrong, like a missed break clock-in, she doesn’t need to stop what she’s doing or manually track down errors. The system gives her visibility into who is approaching or exceeding their allowed hours, so she can stay present on the floor rather than buried in corrections.

Just as importantly, many FECs rely on multiple disconnected systems—POS, scheduling, time tracking, HR, payroll—and the friction between those tools can cause errors and long administrative delays. Bria experienced this firsthand before consolidating. “With the other apps, we had to schedule in one system and fix timesheets in another. It was a whole thing,” she says. “With Workforce.com, I can do everything in one place. It saves time and lets me focus on people having fun.”

Watch: The Software Behind the Fun: How Workforce.com Powers Altitude Richardson

Bria’s story reflects a broader trend across the industry: FECs succeed when they streamline processes, improve compliance, and consolidate disconnected systems into a single operational hub. As organizations head into 2026, businesses with large hourly workforces will need technology that understands the realities of shift-based work and helps them manage complexity without adding more of it.

2026 will widen the gap between businesses that adapt and those that do not. Businesses that will win are those bold enough to evolve and recognize that old systems cannot support new labor realities.

Success will not come from working harder. It will come from building workflows that anticipate issues, respond quickly, and keep hourly teams moving in the right direction. The organizations that choose to modernize now will be the ones setting the pace next year.

Ready to transform your business in 2026? Book a demo today.