Summary

- Challenges with overtime calculations don’t just come with the math. It’s all the manual processes involved, especially with different pay conditions and compliance rules.

- Overtime calculations can be simplified. In fact, an LA-based organization reduced time processing timesheets by 92%.

- Payroll software can significantly reduce errors and time spent on calculating overtime.

Overtime pay calculations can feel like a full-time job, even if it’s just one of the many things that go into payroll. Different pay rates, tracking total number of hours, changing schedules, and compliance rules make it tricky, especially when you’re running an hourly team on multiple shifts. When you dig deeper into it, however, the real problem isn’t the math. It’s the manual work.

So, how can you simplify the process, reduce errors, and ensure that employees are paid on time? Here are five practical ways to do so.

1. Improve your onboarding process

Onboarding is not just about welcoming new hires. It’s about setting up systems that make payroll, including overtime, easier to manage.

When we think of onboarding, we usually focus on getting new hires up to speed and integrated into the team. But the behind-the-scenes admin work during this stage plays a massive role in how seamless (or messy) payroll and overtime processing will be down the line.

Proper onboarding ensures accurate classification from day one. If you misclassify employees (exempt vs. non-exempt), you can face overtime compliance issues later on. This is also the perfect time to set clear expectations around overtime—when it kicks in, what overtime premium rates apply, straight time pay policies, and other relevant conditions.

Onboarding is also the time to get new hires up and running on your time-tracking system.

Show them how to clock in and out correctly and how time logs are generated into timesheets. Getting new hires set up in your time-tracking system early prevents payroll errors later.Onboarding on its own can feel like too much admin and paperwork. Workforce.com has an automated system for getting new hires onto your system. New hires get a link to the onboarding platform and input their information, minimizing errors and admin work for your team. You can also upload contracts, handbooks, and other key documents, plus create employee profiles with base pay and classifications.

2. Automate time and attendance tracking

Employee work hours are at the core of processing payroll and calculating overtime pay. Manually processing timesheets and payroll is not only time-consuming but also increases the risk of payroll errors, underpayments, and compliance issues.

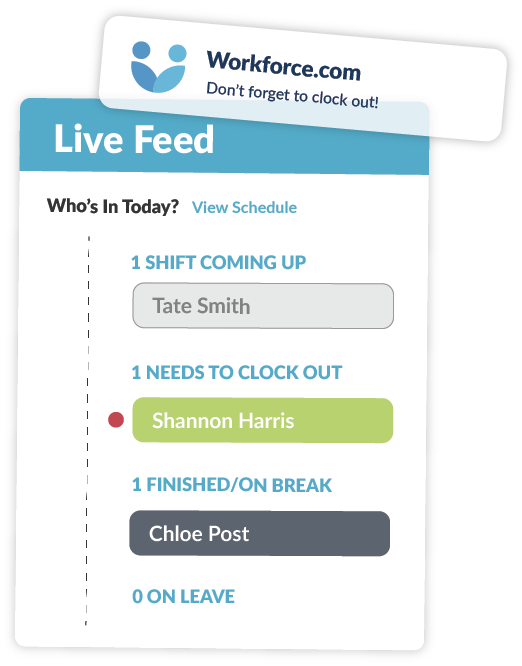

An automated time and attendance system ensures all hours of work are recorded accurately, so you don’t have to second-guess overtime calculations. Workforce.com captures time logs through a tablet placed on your job site or directly from an employee’s mobile phone. The system logs location data, which is essential if you manage teams in different locations.

Clock ins and outs are generated into timesheets, indicating the total number of hours. Overtime hours are flagged, and managers can quickly review and approve in seconds and fix any discrepancies before payroll processing.

For Lisa Hanna, business manager at Ethos Orthodontics, payroll used to be a three-day ordeal. “Generally, I’d spend a few hours each Sunday printing out and processing timesheets to get them ready for payroll that week,” she shared.

With Workforce.com, Hanna got her Sundays back as the system prepared the timesheets for her. It now only takes a few clicks to approve and export timesheets for payroll, reducing the admin load and compliance risks.

3. Set overtime alerts

Overtime is sometimes necessary, but it shouldn’t be eating into your budget unless it absolutely needs to.

Workforce.com keeps overtime under control with real-time visibility. When scheduling, managers get an alert when an employee is scheduled for more than their regular hours. If it’s intentional, great—no surprises on payday. But if it’s an accident? You can fix it before it turns into an unnecessary payroll expense.

The system also flags when employee hours are about to hit overtime. If someone’s shift is over but they’re still clocked in, managers get notified. At that point, they can check in: Did the employee forget to clock out? Are they actually working? If so, is overtime work truly needed, or can the task wait until the next shift?

These real-time alerts prevent unplanned overtime, keep labor costs in check, and even promote better work-life balance for your team.

4. Use payroll software

Payroll software can simplify overtime calculations, but only if it’s built to handle the complexities of your workforce.

Consider your payroll needs and go for the solution that meets your requirements. Whether you’re looking for software or planning to switch to a different system, consider the following:

- Overtime and labor laws – Can it keep up with changing labor laws? Does it account for both federal and state overtime rules? Can it automatically update tax rates?

- Integration and data entry – Does it sync well with time tracking and HR? Can data flow smoothly from one module to the next, or will you be stuck with manual entry?

- Customization – Aside from employee’s regular rate, can it handle shift differentials, different rates, fluctuating workweeks, non-discretionary bonuses, weighted average calculations, and other conditions and exemptions?

- Ease of use and implementation – How long does it take to roll out? Can employees actually use it without a steep learning curve? Even the most advanced features are useless if your team avoids the system.

Mikhuna, an LA-based food truck business, teamed up with Workforce.com to simplify payroll processing, time and attendance tracking, and employee scheduling. Because everything is now done on a single platform, they saw a 92% decrease in time spent correcting timesheets and saved three hours on payroll processing.

“It used to take me between two to three hours to run payroll,” Cynthia Carreiro, Mikhuna’s CFO, shared. “Now it takes no more than 3 minutes.”

Beyond saving time, Mikhuna also gained real-time visibility into labor costs. “A year from now, I’ll be able to look back at a pay run from the same time last year and see if I’m losing or making money,” Carreiro adds.

When payroll software is built right, it doesn’t just save time. It gives you the insights you need to make smarter business decisions.

5. Understand overtime rules that apply to your workforce

Even with the best payroll software, your managers and HR team still need a firm grasp of how overtime rules work not only for processing payroll but also for answering employee faqs.

At the very least, managers should know existing federal laws and state rules around overtime. Under the Fair Labor Standards Act (FLSA) rules, nonexempt employees must receive overtime pay for hours worked in excess of 40 in a workweek at one and a half times their regular rate of pay. But here’s the kicker—what actually makes an employee exempt or nonexempt? The Department of Labor set the guidelines on what makes an employee exempt or non-exempt to overtime pay. While hourly employees are typically non-exempt, salaried employees may also be entitled to overtime if they meet the criteria on salary levels and job duties.

What about regular rate of pay calculations? What goes into in exactly? Aside from regular hourly rate, salaries (for salaried, nonexempt employees), nondiscretionary bonuses, shift differentials, piece-rate pay, and commission must be included in the computation.

Leadership teams should be able to provide a clear, high-level explanation on these areas, especially when they concern employees’ total compensation.

Also read: Exempt vs. non-exempt employees: knowing the difference

If you operate in a state with stricter overtime laws, that’s another layer of compliance to manage. Take California, for example. Daily overtime is recognized in California, which means that workers are entitled to overtime payments when they work more than 8 hours in a single workday or over 40 hours in a single workweek. This is different from FLSA rules, which calculate total overtime based on hours worked in a 40-hour workweek rather than a single workday

The overtime pay rate also varies in California. Employers must pay one and a half times the regular rate of pay after 8 hours a day. But double time or twice the regular rate of pay takes effect for employees who work after 12 hours a day or after 8 hours on the seventh consecutive workday.

Also read: California Overtime Laws Explained: What Employers Need to Know

Payroll software can handle the calculations for you according to applicable federal and state laws. However, your team still needs to understand the rules, both to ensure your systems are running correctly and to confidently handle employee questions.

Stop Working Overtime to Calculate Overtime

Calculating overtime wages shouldn’t steal your weekends or keep you at the office late. With the right system, you can automate not just the math but also streamline its administrative side.

Workforce.com automatically calculates overtime, no matter how complex your pay setup is. Whether you have shift differentials, double time, fluctuating workweeks, or non-discretionary bonuses, the system handles it all.

It also keeps up with labor laws to ensure compliance at every step. Need to update an employee’s pay rate or adjust your overtime policy? Just enter it once, and the system updates everything—from time tracking to payroll—without extra work on your end.

Overtime shouldn’t be an admin nightmare. See how Workforce.com makes it simple for businesses worldwide. Check out our customer stories or book a demo today.