Summary:

- Wage and hour lawsuits often stem from uncaptured work time, not from missing punches.

- Because labor laws define “hours worked” differently across jurisdictions, how time tracking systems are configured matters.

- The right time tracking software helps surface gaps early and reduces compliance risk.

The most expensive wage claims don’t always come from missed punches. Sometimes, they come from an employer’s failure to track compensable time according to labor laws. For organizations, the challenge is operationalizing those requirements through how time tracking systems are set up.

How untracked work could turn into a lawsuit

A recent wage settlement illustrates how everyday tasks not recorded as work time can expose employers to serious legal risk.

In a case involving a Target distribution center operations in New Jersey, a group of hourly, non-exempt employees alleged they were not compensated for time spent on required activities before and after their scheduled shifts. According to the complaint, workers were required to complete pre-shift activities—including passing through mandatory security screenings and walking long distances from facility entrances to their assigned workstations—before clocking in. After clocking out, employees had to walk back through the same controlled areas and security checkpoints before leaving.

The plaintiffs argued that the time spent on these activities should be considered hours worked under applicable wage laws and that excluding this time from pay calculations resulted in lower wages and incorrect overtime amounts..

Target denied the allegations and maintained that these activities were not compensable. Nonetheless, to avoid protracted litigation and ongoing risk, the company agreed to a $4.6 million settlement covering eligible current and former workers at the affected New Jersey facility.

Also read: Time Clock Rounding: Best Practices & Compliance Risks

Why configuration matters

When wage and hour lawsuits make headlines, it’s easy to assume the issue stems from outdated or manual systems. In reality, most large employers already use automated time tracking. Employees clock in and out, and hours are recorded consistently.

The risk tends to emerge elsewhere. It often comes down to how time tracking systems are configured, and whether the policies built into those systems reflect how work actually happens on the ground.

Labor laws are not always intuitive, and day-to-day operations don’t neatly map to the fine print of wage regulations. Oftentimes, compliance issues surface when required activities fall outside what systems are set up to capture. And those gaps go unnoticed.

That challenge is compounded by the way wage laws are structured. Federal wage law draws a relatively narrow line around what counts as paid work. Many state laws draw a wider one. As a result, activities such as security screenings or walk time, may be unpaid under federal rules, but still create liability under state law.

Platforms like Workforce.com are built with this reality in mind. They provide guardrails that support accurate time capture, consistent policy enforcement, and clear documentation across the workforce. That level of visibility is critical for day-to-day operations, especially when reviewing policies, preparing for audits, or responding to legal or regulatory inquiries that require a clear record of how employee time was tracked and paid.

Why feedback becomes a crucial compliance guardrail

In theory, it may seem straightforward to treat activities like pre-shift and post-shift screenings or long walks through controlled areas as paid time. In practice, those decisions are rarely simple. Whether time should be counted often depends on how work is structured, how much control the employer exercises, and how applicable wage laws are interpreted at the state level.

That complexity is challenging to navigate in real time. Labor rules evolve, guidance can be unclear, and the way work actually happens day to day doesn’t always match written policies or out of the box system configurations.

This is where employee feedback becomes a powerful compliance guardrail. By giving employees a structured way to share feedback at the end of a shift, organizations gain visibility into what actually occurred during the workday. Patterns like required activities outside scheduled hours or delays that extend time on site can surface quickly.

Catching these signals early allows employers to review configurations, clarify policies, and address issues before they escalate into formal complaints, investigations, or costly wage and hour disputes.

Ultimately, wage compliance issues surface most visibly in payroll. When time tracking doesn’t reflect the work, those gaps affect pay calculations, regular wages, and overtime.. By the time issues show up in payroll, the risk has already compounded. That’s why accurate time capture and system configuration are so critical.

Also read: 5 Tips to Simplify Overtime Calculations

Using the right technology to track time and stay compliant

Staying compliant ultimately comes down to visibility and consistency. Employers need systems that accurately capture time and surface potential issues before they escalate.

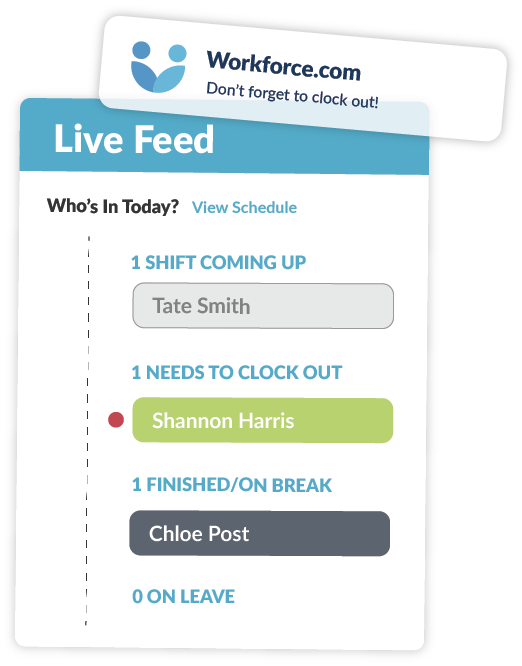

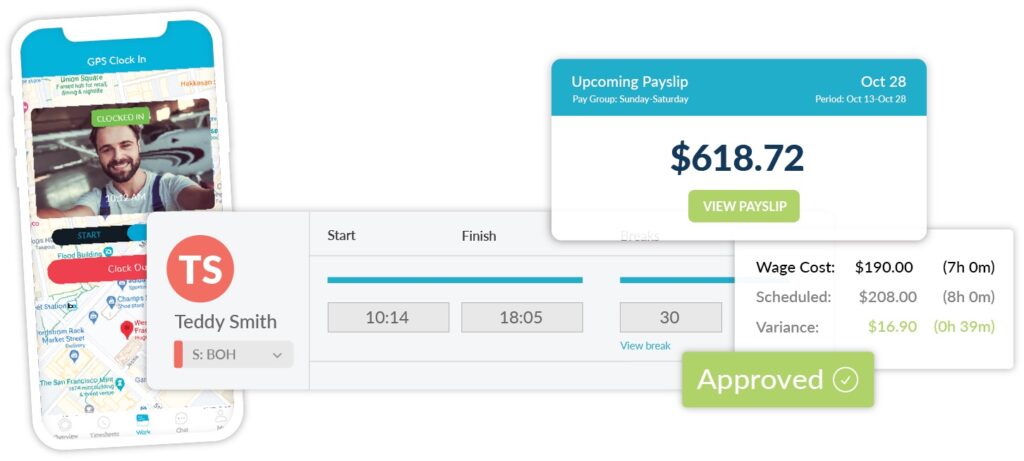

Workforce.com brings these capabilities together in a single platform. It allows organizations to track employee time accurately, configure rules based on their policies and applicable labor laws, and gather shift-level feedback that provides insight into day-to-day operations.

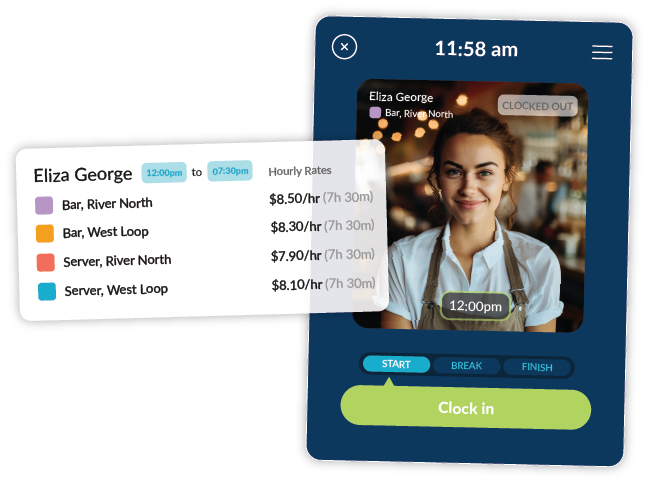

At the core is Workforce.com’s time and attendance tracking, which supports accurate time punches, and helps teams monitor common risk areas. The platform can flag missing time logs, missed breaks, and approaching hour thresholds. This allows managers to address issues in real time rather than after the fact.

Alongside time tracking, Workforce.com’s shift feedback tools give employees a simple way to rate their shift and share comments on what worked and what didn’t. Over time, this feedback can surface patterns that indicate policy gaps or potential compliance issues, allowing employers to review configurations and make proactive adjustments.

Wage and hour compliance is complex, particularly for organizations with large hourly workforces. But with the right technology in place, it becomes easier to align policies, systems, and day-to-day operations. Learn how Workforce.com helps hourly teams bring time tracking, scheduling, HR, and payroll together in one platform. Book a call today.