Summary

-

The FLSA allows for time clock rounding, provided that it is done either neutrally or in a way that favors the employee.

-

Rounding to the nearest 5, 6, and 15 minutes are accepted under labor rules, but knowing when to round up or down can be tricky.

-

The right technology can equip companies to conduct time clock rounding while avoiding compliance violations.

Time clock or timesheet rounding allows organizations to round an employee’s clock in or out time by up to 15-minute intervals, often giving them cleaner employee hour numbers to work with. Still, the practice of time clock rounding has its limitations.

While it is a common practice, there are liabilities that companies may face by relying on it, and the use of certain technology solutions may simplify the timekeeping and payroll process so that time clock rounding becomes easier.

But first, let’s look at what labor laws say about it.

Is time clock rounding legal?

According to the FLSA (Fair Labor Standards Act), employers can round their employees’ clock-in and clock-out time to the nearest 5 minutes, the nearest one-tenth of an hour or 6 minutes, or the nearest quarter hour or 15 minutes.

So, yes, it’s legal, but you can’t just implement it haphazardly. The Department of Labor (DOL) allows this provided “it is used in such a manner that it will not result, over a period of time, in failure to compensate the employees properly for all the time they have actually worked.”

On the other hand, the law also recognizes that there can be “infrequent and insignificant periods of time beyond the scheduled working hours, which cannot as a practical matter be precisely recorded for payroll purposes, may be disregarded. The courts have held that such periods of time are de minimis (insignificant).” However, it’s important to note that employers must count every actual minute spent working and should tread with timesheet rounding and de minimis time with common sense.

When does timesheet rounding become illegal?

Time clock rounding becomes warrants legal action when it’s unfair to the employees and leads to inaccurate time cards.

At the maximum, employers can only round to 15 minutes or a quarter of an hour. It’s a violation if an employee comes in at 8:12 and you round it to 8:30. Considering the 7-minute rule, you should round it to 8:15.

If, for example, you round to the nearest one-10th of an hour or 6 minutes, and an employee clocks in at 8:58 and leaves at 6:04, it becomes a violation if you round to 9:00 and 6:00 because it is clearly to your advantage and you underpaid them for 5 minutes. It should be 9:00 and 6:06 to account for all time worked. Six minutes may not seem much, but if it’s consistently done, it can amount to hours of unpaid work overtime. And that can ultimately lead to wage theft and a costly lawsuit.

While the law allows timesheet rounding, it can be tricky to navigate. And it would be best if you only did so unless it’s really necessary for you.

Should you do time clock rounding?

It depends, but the most important thing to remember is that time clock rounding rules should be at least neutral and more to benefit employees. So, if your goal with rounding is to save on labor costs, there are honestly better ways to do this than timesheet rounding. Focusing instead on labor forecasting and scheduling based on demand as a means to optimize your costs is probably a smarter (and less risky) way to go.

Webinar: How to Forecast Your Schedule Based on Demand

The primary reason why business owners turn to timesheet rounding is for easier payroll processing, especially for those organizations that don’t have an automated system to track time. Rounding employee time gives organizations cleaner numbers to work with for payroll calculations.

Employers also do time clock rounding to promote flexibility and simplify billing and invoicing.

But keep in mind that you need to consider employee perception in all of this. Employees might think that time clock rounding is being used to shortchange them. In the same vein, employees could also exploit the rules as a means of time theft.

The key here is to understand whether there is a need for timesheet rounding in the first place. And if there is, you must clearly communicate the policy to your employees. See to it that they understand why and how it’s done.

Timesheet rounding rules

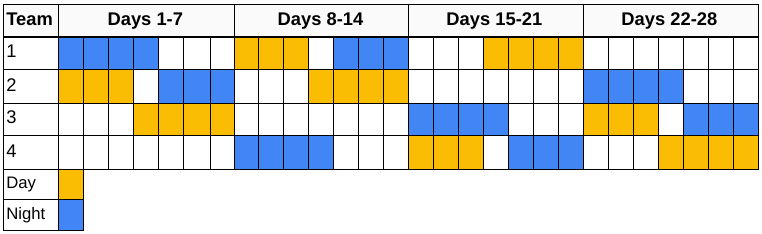

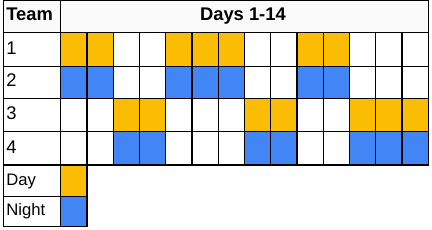

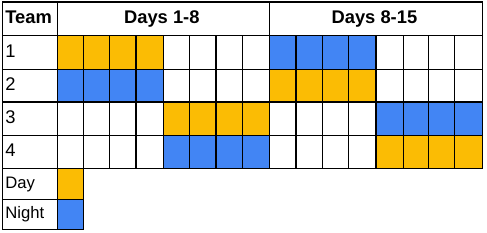

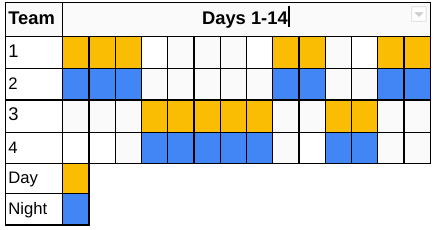

Three rules govern standard practices for timesheet rounding, and these are acceptable increments under the FLSA. You can opt to round time to the nearest 5 minutes, 6 minutes, or 15 minutes.

Whatever increment you choose, know when to round up or down. The threshold is the halfway mark between these rounding increments and would determine whether you should round up or down. Say you’re conducting 5-minute rounding; the threshold is at 2.5 minutes. So, for instance, if an employee clocks in at 8:02, that should be rounded to 8:00.

The key here is to know how to round employee time according to FLSA rules. While it seems straightforward, it can be tricky as there appears to be some ambiguity around de minimis time.

“The de minimis doctrine is important in timesheet rounding cases because it asserts that the law can disregard infrequent or insignificant periods of time that would be impractical to precisely record,” Michael Cardman, legal editor at XpertHR, said.

In Corbin v. Time Warner Entertainment, for example, the plaintiff alleged that he lost $15.02 because of his company’s compensation policy, and the court ended up rejecting the plaintiff’s argument that the company’s rounding policy violated the federal rounding regulation.

Meanwhile, Starbucks saw a different outcome in Troester v. Starbucks Corp. The plaintiff would clock out at night and still have a few tasks to complete to close the store. It added up to a short period of time every night, Cardman said. Starbucks wanted to exclude that time under the de minimis doctrine, but the costs added up along with potential overtime pay. According to the California Employment Law Report, over 17 months, the plaintiff did not earn wages on 12 hours and 50 minutes of work, adding up to $102.67 in wages.

Best time rounding practices

Should you need to implement time clock rounding, here are a few best practices to consider:

When in doubt, round in favor of employees

If for some reason you can’t round neutrally, always round in favor of the employee and not the employer; this limits your liability in the long run.

For example, say a staff member clocks in at 7:57 a.m. and clocks out at 3:56 p.m. Rounding the start time to 7:55 a.m. and the end time to 4:00 p.m. would be in favor of the employee and maximize their earnings. Putting the employee first is always a safe bet for rounding time.

Follow FLSA rules

Always adhere to federal law for timesheet rounding. More than following the accepted increments and thresholds—nearest 5, 6, and 15 minutes- you must also practice fairness when rounding employee time.

See to it that you’re not unconsciously underpaying your staff. A 3-minute discrepancy today may not seem much, but when these variances frequently occur, they can quickly balloon into a considerable amount.

Be careful with unpaid meal breaks

Rounding break times is not advisable, as you can violate state-based and federal rules. Employees must take these breaks and should be free from any work duties at this time, so it’s best to track actual minutes.

A good time-tracking software dramatically helps with this. For instance, Workforce.com has functionality that allows employees to clock in and out during break times. This helps ensure they take breaks and use all their entitled minutes. Not only will this promote a good working environment, but it will also help ensure that you remain compliant with applicable break rules.

Audit your timesheet rounding policy on a regular basis

Like any HR practice or policy, you must regularly revisit your time rounding policies. Operations evolve over time, and it’s best to reevaluate whether this policy still serves its purpose periodically. If you’re timesheet rounding policy makes bookkeeping and payroll easier, then you’re on the right track. However, if the policy is in place purely to save on labor costs, you’re treading dangerous waters. The law clearly states that rounding should be at least neutral and for the benefit of the employees. Labor forecasting and demand-based scheduling are more sound strategies for optimizing labor costs than rounding times to save a few minutes here and there.

Get it right with automation

Rounding employee time without the aid of time and attendance software is risky. Without the proper safeguards in place, you could find yourself with erroneous data and consistently underpaid and unhappy staff.

A time and attendance system streamlines how you record time entries and saves you from non-compliance issues caused by inaccurate rounding practices.

Workforce.com is a best-in-class HCM platform that simplifies time clock rounding. It tracks and records employee work times down to the second and can be configured to automate your very own time clock rounding policy.

Discover how Workforce.com can help you simplify time and attendance, employee scheduling, payroll, and labor compliance. Book a call to know more.