- Payroll is a process involved in calculating wages, applying deductions, and distributing pay to employees. Payroll for hourly teams can be more complex because of variable schedules and multiple pay rates.

- Payroll can be simplified with payroll software. But it can be tricky to find the best one.

- Payroll software can streamline the process, provided it has the functionality to ensure the accuracy of wage information and calculations.

Payroll is one of the most critical and complex parts of running a business. At its core, it’s all about calculating employee wages, applying deductions, and issuing payments. But behind every paycheck is a complex system of moving parts, from tracking hours to ensuring compliance with tax and labor laws.

For many business owners, especially those with hourly staff, payroll can become a significant pain point. Chasing down timesheets, calculating overtime, applying the correct pay rates, and reconciling records is very time-consuming and can result in significant amount of hours spent on administrative tasks.

So, what exactly is payroll? And what should organizations look for in software to help them run payroll smoothly, especially if you’re managing hourly teams?

What is payroll?

Payroll is the process a business follows to pay its employees accurately and on time. It involves several key steps: calculating gross wages, withholding the correct amount of taxes, applying deductions such as garnishments or benefits, and issuing the final pay.

But payroll doesn’t start and end with just cutting checks. Before payday, it requires pulling data from onboarding, time and attendance systems, and any applicable leave balances. After wages are finalized, employers must remit payroll taxes and file the necessary reports.

In short, payroll is where everything comes together. More than a back-office task, it’s a core business function that directly impacts employee satisfaction and trust.

What does payroll mean for hourly teams?

Payroll is already a complex process, but it’s even more challenging for hourly teams.

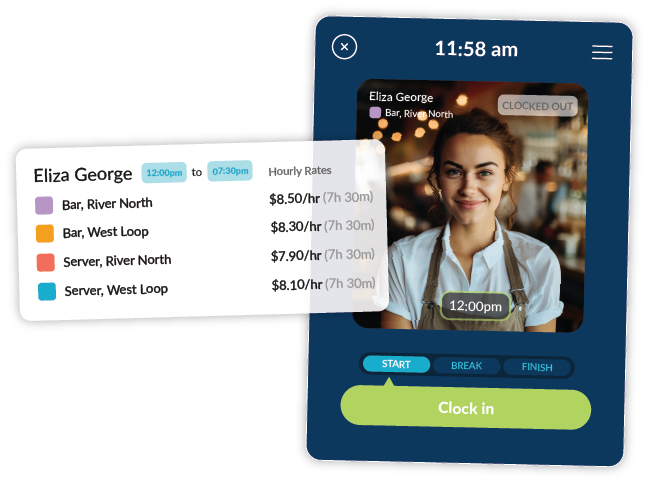

Unlike salaried payroll, which tends to stay consistent from cycle to cycle, hourly payroll is filled with moving parts. Pay can vary based on scheduled hours, roles worked, locations assigned, and local labor laws. These variables can drastically affect how gross pay, taxes, and deductions are calculated.

Take Dave, for example. He works at a restaurant where he’s qualified for multiple roles. Some days, he’s a server; other days, he’s a bartender—each with a different pay rate. Additionally, he may be assigned to various locations, each with its own wage rules and tax rates. These variations make processing payroll more complex. Now multiply that across 100 employees, and it’s easy to see why hourly payroll needs more than just a basic system.

It’s not just calculations, either. Employers must also stay up-to-date with state-specific pay frequency requirements. For instance, in Virginia, salaried employees must be paid at least monthly, while hourly workers must be paid at least twice a month or every other week. These rules vary across jurisdictions and can’t be ignored.

For teams with shift-based staff, payroll isn’t a “set it and forget it” task. Automation helps, but only if the software is built to handle the unique needs of frontline and hourly operations from end to end.

TL;DR: Payroll for hourly teams is more complex due to variable hours, multiple pay rates, shifting locations, and evolving labor laws. Getting it right takes the right tools.

What is payroll software?

Payroll software is a tool that automates the calculation and processing of employee wages and salaries. It utilizes employee data, including hours worked, pay rates, and leave balances, to calculate pay, apply deductions, and issue payments in accordance with company policies and labor laws. It also generates pay stubs that provide employees with a clear breakdown of their earnings, taxes, and other adjustments.

Payroll software’s primary purpose is to calculate and process employee wages using employee information and in accordance with labor laws and company policies. It also takes into account any adjustments based on leaves, holidays, and bonuses. After calculations, payroll is distributed to employees. Payroll systems often support direct deposits, sending wages straight to an employee’s bank account. Self-service access also lets employees update bank account details securely.

Payroll systems also help genrate pay stubs or payslips, which are documents that provide a breakdown of how pay was calculated.

Payroll software can be standalone, which means that it’s solely designed to calculate pay. If it’s a standalone product, you must provide the information and data it needs to calculate employee pay.

There are different types of payroll software:

- Standalone payroll software focuses solely on calculating and distributing pay. Necessary data, such as hours worked and overtime, must be manually input for each pay run.

- On-premise payroll software is installed on a company’s local servers. While this offers control over data, it typically requires a significant amount of IT infrastructure and ongoing maintenance.

- Cloud-based payroll software is hosted online and accessible from anywhere. It usually offers automatic updates, easier scalability, and less overhead for IT teams. In addition, it is often referred to as online payroll solutions because it allows you to process pay from anywhere with internet access.

Some payroll software is part of a larger human resources platform that includes tools for time and attendance, scheduling, and workforce management. In this setup, payroll pulls real-time data from these modules, which reduces manual entry, improves accuracy, and saves time.

What to look for in payroll software especially for hourly teams

With so many payroll providers on the market, it can be overwhelming to choose the right one.

While most software promises to simplify payroll, not all of them are built to handle the business needs of hourly or shift-based teams.

Here are the most essential features to look for in payroll software and questions to ask as you evaluate your options.

Ease of use

Adopting any new software has a learning curve, but it should be user-friendly enough to allow users to get up and running faster. So, what makes payroll software user-friendly?

A good payroll system should be easy to navigate, even for non-technical users. While some learning curve is expected, it should help your team get up and running quickly without constant IT support.

Key features to look for:

- Accessible across devices: The software should function consistently on both desktop and mobile devices.

- Intuitive design: A clean, user-friendly interface encourages adoption.

- Minimal training required: Managers and admins should be able to handle payroll tasks without frustration or delay.

Even the most powerful system won’t be effective if your team doesn’t want to use it.

Accurate wage and tax calculations

Hourly payroll is complex. Your payroll software should have safeguards that ensure every pay run is accurate, no matter how many variables are in play.

Ask these questions:

- Does it support multiple pay rates and roles?

- Can it handle overtime, bonuses, and tips accurately?

- How are time and attendance data synced, automatically or manually?

- Does it manage federal, state, and local tax withholdings?

- How does the platform help minimize payroll errors?

Accuracy is more than automation. It’s about controls and checks that fit your business.

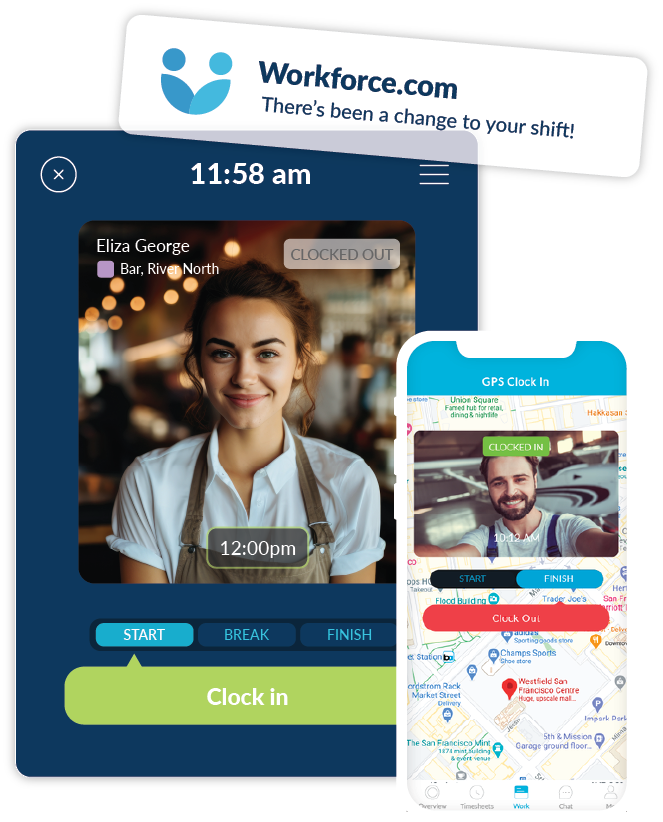

Time tracking integration

Payroll accuracy starts with accurate time tracking. Choose a solution that integrates directly with your time and attendance tools or, even better, one where these tools are built into the same platform.

Benefits:

- No double entry or data transfer errors

- Real-time syncing of hours worked

- Easier management of breaks, PTO, and shift differentials

Reporting and audit support

Good payroll software doesn’t stop at just wage calculations. it also helps centralize and organize your payroll data to make reporting, audits, and decision-making much easier.

Look for:

- Built-in reports for federal and state requirements

- Custom report builders for internal insights

- Central access to payroll history and data

Whether you’re preparing internal summaries or government forms, payroll reporting tools should let you filter and export the data you need easily.

Customization and Flexibility

Most payroll systems typically come with default settings, but a good one also adapts to your specific requirements. This is especially important for those with more dynamic needs, such as frontline teams and hourly workers.

Here are some questions to ask:

- Can you set rules for multiple roles, rates, and locations?

- Can you configure custom pay periods or alerts for overtime and missed breaks?

- Can the system handle tipped wages and industry-specific rules?

- Can you automate break compliance and ensure that required penalty pay is issued if rest or meal breaks are missed?

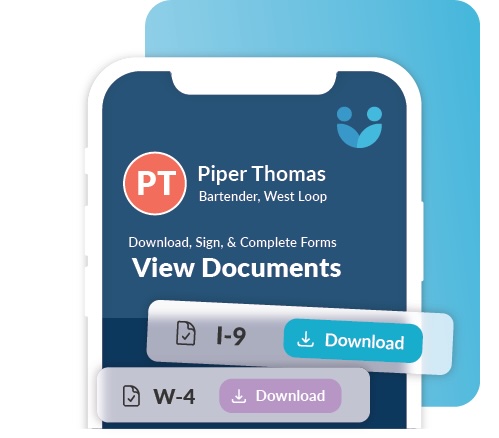

Employee self-service

Empower your staff with access to their payroll information. A self-service portal reduces admin workload and builds transparency.

Employees should be able to:

- View pay stubs, W-4s, and timesheets

- Update personal and banking information

- Track PTO balances and request time off

- View schedules and shift history

Built-in compliance tools

Payroll software should support federal, state, and local tax compliance, while also helping you meet wage laws, recordkeeping requirements, and audit readiness.

The system should:

- Alert you to rule violations

- Maintain digital records for audits

- Help you stay up to date with changing labor laws

Reliable customer support

Payroll issues can’t wait. Select a provider with a knowledgeable and accessible support team, particularly during implementation and your initial pay runs.

Why Workforce.com’s payroll software is the best choice for hourly and shift-based teams

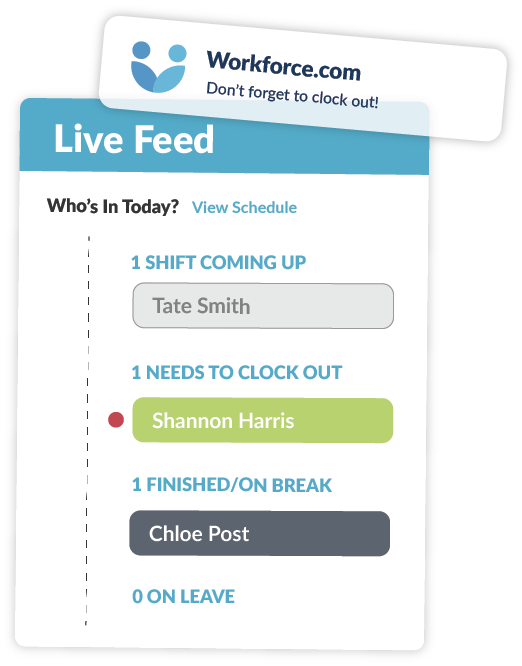

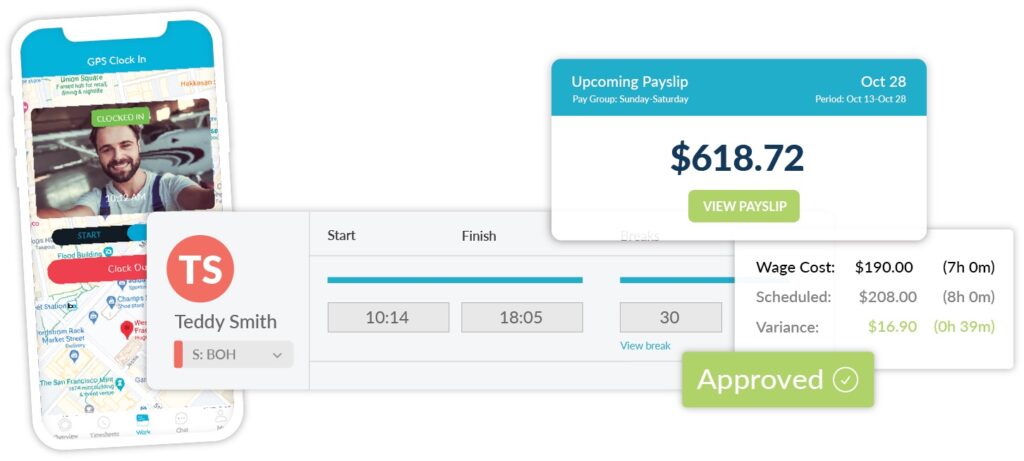

Workforce.com is a full-service payroll platform built for hourly, shift-based, and frontline workforces. It’s more than just a payroll calculator. It’s a complete workforce management suite designed to automate, simplify, and safeguard every step of the employee lifecycle, from onboarding new hires to payday.

Here’s why it stands out:

- Accurate pay for complex teams: Handles multiple rates, roles, and locations with ease

- Real-time time tracking integration: Built-in time and attendance means no data re-entry

- Flexible compliance tools: Designed to help you follow federal and state wage laws with configurable pay rules and alerts for your locations

- Employee self-service: Mobile-friendly tools for staff to manage pay, schedules, and more

- End-to-end visibility: See everything from scheduling to pay in one system

Workforce.com serves industries such as hospitality, healthcare, and more, helping to reduce payroll errors, save time, and ensure compliance. Book a call today to see how Workforce.com can simplify your payroll process.

FAQs about Payroll and Payroll Software

What is payroll in simpler terms?

Payroll is the process of paying employees their wages and salaries on a regular basis. It involves calculating wages, withholding taxes, and ensuring compliance with legal requirements.

How does payroll software work?

Payroll software automates tasks such as wage calculations, tax withholdings, direct deposits, and reporting. It reduces manual work and helps prevent errors.

Why is payroll more complicated for hourly workers?

Hourly payroll often involves variable shifts, multiple pay rates, overtime, and tip reporting. These moving parts can make payroll more complex and more challenging to manage manually.

What’s the best payroll solution for hourly teams?

The best payroll solution for hourly teams or shift-based workers is one that’s in the same ecosystem as time tracking, scheduling, and onboarding. It should support multiple pay rates, variable schedules, overtime, tip management, and compliance. An employee self-service functionality is also a must for hourly workforces.

Can payroll software help with taxes?

Yes. Most payroll software automatically calculates and applies federal and state tax rates, helping ensure tax compliance. Many also generate tax forms and reports to support timely and accurate filing.

What are other ways to process payroll aside from payroll software?

Some companies opt for in-house payroll, where they use manual processes like spreadsheets or accounting tools. Others outsource payroll entirely to accountants or payroll service providers who manage the process and handle tax filings on their behalf.