Summary:

-

Federal and state laws govern how employee records are kept and for how long. These rules can differ by location and industry.

-

Managing employee records is a tall order, but HR software keeps thing simple, allowing staff to update their own info digitally.

-

Download and modify this employee change of address form template for free.

With a small staff count, organizing, tracking, and updating employee records is relatively straightforward for any HR department. But if you have a rapidly scaling business, staying on top of personnel information might be a little more challenging.

To keep things organized in all of this chaos, you need to keep accurate records. When an employee’s mailing address needs to be updated, you’ll need to rely on more than just word of mouth to get this information processed.

Many HR departments use a change of address request form. Download ours here – feel free to copy, save, and modify it.

Using a simple form like this is only the first step in accurate record-keeping. It is 2024; let’s be honest, people don’t use printers anymore. Or at least they shouldn’t be.

Well, that might be a tad extreme. But you know where I am going with this.

All kinds of records, such as employee names and emergency contact details, will change over time. Add leave request forms, benefits enrollment, and other templates into the mix, and you’ll realize how quickly recordkeeping can become an administrative burden.

Paper forms < Going paperless; Here’s why.

Luckily, you can avoid repeatedly downloading 15+ paper forms to manage your workforce records by using HR software.

Here are three ways where HR software can help you get a better grip on employee record-keeping:

1. United employee records in one place.

You can collect all of your employee information in one system without storing random paper forms in dusty, beige filing cabinets scattered around your office. Typically, organizations keep some form of the following employee details:

Time and Attendance

This information is essential to staying on top of your day-to-day operations. This includes records on the clock ins and outs, time off, employee schedules, tardiness, absences, and hours worked.

Benefits

Insurance enrollments, health coverage, and other company benefits all fall under this category. It can also include records involving the Americans Disabilities Act (ADA), the Occupational Safety and Health Administration (OSHA), and the Family and Medical Leave Act (FMLA). Staying on top of these records will help you comply with federal laws like the Employee Retirement Income Security Act (ERISA).

Payroll

Details that have something to do with a person’s pay computation go under payroll information. Details like wages, hourly rates, withholdings, tax forms, timesheets, direct deposits, and W2 and W4 forms all fall under one umbrella.

Personnel information

These are basic details that typically go under an employee’s file. This includes name, home address, phone number, employment history, emergency contact information, and other new employee paperwork. Over time, this file will consist of documentation around performance reviews, awards, disciplinary records, training, termination, and further employment-related details.

Medical records

Medical records include doctor’s notes, drug tests, medical exams, and medical expense reimbursement requests.

Separation of employment records

These records are related to an employee’s departure from the organization, including resignation letters, unemployment documents, reasons for separation, whether voluntary or involuntary, and exit interviews.

2. Compliance with employee record-keeping rules

There are federal rules and state-based rules that govern the type of information you can retain and for how long. Here’s a brief overview of some of these regulations:

Fair Labor Standards Act (FLSA)

Federal and state-based rules govern the type of information you can retain and for how long. Here’s a brief overview of some of these regulations:

-

-

-

- Employee’s full name and social security number

- Address, including zip code

- Birth date, if younger than 19

- Sex and occupation

- Time and day of week when employee’s workweek begins, hours worked each day, and total hours worked each workweek

- Basis on which employee’s wages are paid

- Regular hourly pay rate

- Total daily or weekly straight-time earnings

- Total overtime earnings for the workweek

- All additions to or deductions from the employee’s wages

- Total wages paid each pay period

- Date of payment and the pay period covered by the payment

-

-

Department of Labor (DOL) rules also state that payroll records and collective bargaining agreements must be kept for three years and timesheets for two years.

Equal Employment Opportunity (EEOC)

This regulation states that employers retain employee records for a year. Should a staff member get terminated, their personnel records should be kept for one year after their departure from the company.

Internal Revenue System (IRS)

Under IRS rules, employment tax records should be kept four years after filing the 4th quarter of the year. Some of these records include employer identification numbers, fair market value of in-kind wages paid, and copies of employees’ and recipients’ income tax withholding certificates.

Genetic Information Nondiscrimination Act (GINA) and Americans with Disabilities (ACT)

Both acts mandate that medical information be kept separate from general personnel files. This includes doctor’s notes, disability benefits claim forms, drug or alcohol tests, FMLA requests, ADA requests and documentation, workers’ compensation records, medical exams, health insurance forms, employee assistance program information, and medical expense reimbursement requests.

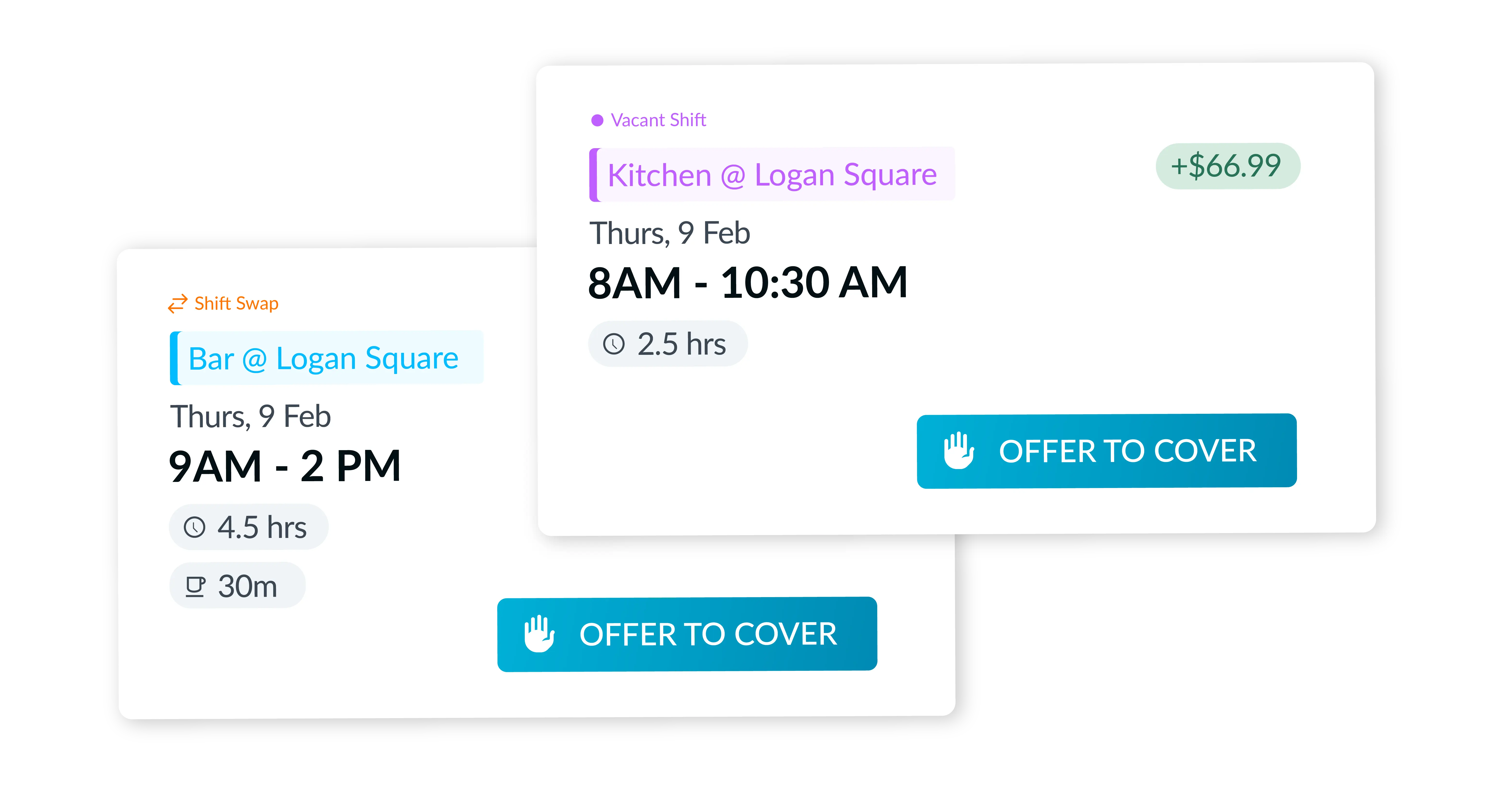

3. Saving time with self-service

The most efficient way to update records is to have staff do it themselves. HR software typically offers employee self-service functionality that allows employees to handle their own recordkeeping, often through a mobile device. With this, they can take ownership of updating their details without having to submit support tickets to HR.

Workforce.com makes employee recordkeeping easy.

Workforce.com is a cloud-based HR system specialized for hourly workforces. It offers complete visibility over employee information, documents, contracts, forms, and other data vital to running your workforce. It’s also built with an employee self-service feature that allows staff to update their details without bothering HR. Likewise, HR managers can configure notifications so they never have to dig to find information on form acknowledgments, onboarding reminders, PTO requests, attendance issues, etc.

Book a call today to get started on ditching paper forms.