Summary

- Small businesses often consider doing their own payroll. This option is feasible, provided you are well-versed in employee wages, tax laws, and payroll regulations.

- DIY payroll may save you from spending on payroll services or software, but there are other factors you must consider to understand whether it’s cost-effective in the long run.

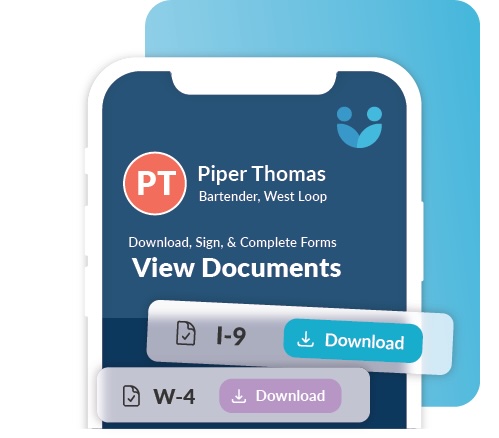

- Much of payroll processing starts before timesheets are generated. It begins with onboarding, making sure that employee information is gathered and accurate.

- Workforce.com’s payroll software takes the stress out of processing pay on your own, handling wage calculations, overtime, deductions, taxes, and more.

If you’re a small business owner or an entrepreneur starting out, you are probably considering doing payroll yourself. And rightfully so – doing this can save you money and give you greater control over your finances.

While this may be true, processing payroll manually presents some considerable challenges, such as keeping track of regulations, taxes, and deadlines.

So, is doing payroll yourself the best choice for your business? In this post, we’ll explore the process of managing payroll yourself while looking into its complexities and potential pitfalls.

What are the steps for processing payroll?

Processing payroll involves several essential steps, from collecting employee data to calculating wages and managing deductions. Here’s a rundown of what these steps include:

Apply for tax ID numbers.

You must have an Employer Identification Number (EIN) before you can pay your employees. It’s required to apply for a business bank account, file taxes, and employ people. You might also need to register for different tax IDs if you operate across multiple states.

Consider setting up an Electronic Federal Tax Payment System (EFTPS), a free tool by the US Department of Treasury to help secure tax payments. The EFTPS allows you to make different types of payments, including estimated taxes, corporate taxes, self-employment taxes, payroll taxes, and excise taxes.

Gather employee information.

Collect essential employee details, including their name, address, phone number, bank details, date of birth, marital status, social security number, and bank details.

You must also have their W-4 forms or tax withholding documents. W-4 documents show how much taxes you should withhold from your employees’ paychecks. Make sure that a new hire accomplishes this during onboarding. Likewise, any employee whose financial situation changes should update their W-4 as necessary. If you hire freelancers, you must let them complete W-9 forms instead.

Financial information such as tax IDs, previous payslips, existing insurance coverage, and tax reports is also essential for processing payroll.

Onboarding can be a time-consuming process that’s heavy with paperwork, especially without an organized system in place. Workforce.com’s onboarding system lets new hires log in and input their details, submit forms, and upload necessary documents ahead of their first day. This streamlines the process, ensuring all paperwork is handled upfront and freeing your HR and payroll team from tedious manual data entry.

Set up a payroll schedule or period.

Determine when you will distribute pay to your employees. Typically, you can process payroll weekly, bi-weekly, semi-monthly, or monthly.

To determine the most suitable pay schedule for your business, factor in the following:

- Cash flow – The important thing here is to ensure that you have enough cash when payday comes. Determine when you’re most likely to be cash-positive and consider timing your payroll around that time. For instance, timing payroll around the same time you pay for utilities and supplies may not be the best move.

- Industry practices – Look at what’s common in your industry. If you employ hourly workers, opting for a biweekly or weekly payment scheme would be best, as they typically prefer more frequent payments than salaried employees.

- State laws or payday requirements – Check if there are prevailing state payday requirements about how frequently you need to pay your employees and when to time it. For instance, Arizona requires that you pay employees two or more days a month as long as they are at most 16 days apart. Meanwhile, in Massachusetts, hourly employees must be paid weekly or biweekly, while salaried employees must be paid at least semi-monthly. The latter can be paid monthly, provided that they agree. These differences and nuances exist around required payday schedules, so factor those in as well.

- Payroll processing time – You must also be realistic about how fast you can process payroll. It may not be wise to set up a weekly payment scheme if you’re doing payroll yourself. Factor in the time you need to gather information and calculate wages.

It’s also important to note that organizations can have multiple pay periods, especially if they employ varied workers. The key to setting the right pay period is to take a look at how your organization operates and what makes the most sense for your employees.

Workforce.com’s payroll system supports a variety of pay schedules—weekly, fortnightly, semi-monthly, and monthly. You can set up multiple pay periods and assign them to different roles. This ensures that employees get paid on the schedule that works best for them. For you, this means one less payroll task to worry about, because it’s fully automated.

Determine payment method.

Direct deposits are usually the standard form of payment for employers to distribute salaries to their employees. However, even as the standard, some prevailing state laws prohibit employers from making this method mandatory.

Other ways to pay employees include cash, checks, pay cards, and mobile wallets. Each method has its pros and cons. For instance, checks can be a good option for employees who don’t want to disclose their bank information, but they can be prone to getting lost and are not immediate. While direct deposits may be more commonplace and convenient, employers must factor in how long it takes for funds to reflect in an employee’s account.

Other considerations include the possible fees that come with each payment method. For instance, pay cards can have setup costs.

As you choose the best payment method for your staff, factor in any prevailing law and what makes the most sense for your employees. Consider providing two options as well. For instance, if an employee can’t be paid through direct deposit because they have no bank account, consider setting up a pay card or issuing paper checks as an alternative.

It would be best if you also issued pay stubs for your employees. There may be state and local laws that have specific requirements around this. For instance, some states require employers to issue printed pay stubs unless the employees consent to receive electronic ones instead.

But regardless of whether it’s mandated in your state to issue pay stubs, it’s still best practice to do so. They are essential for transparency. It includes details about what makes up their pay, such as wages, deductions, and taxes.

Track employee work hours.

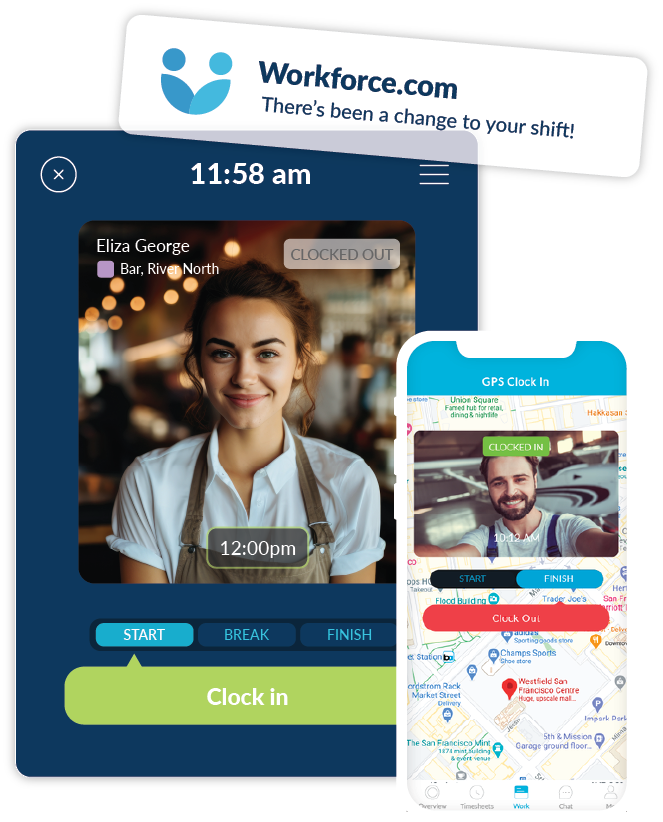

Tracking time and attendance is at the core of processing payroll. Record the hours worked by employees, including regular and overtime hours. It also involves monitoring PTO, leave, and holidays.

There are different ways to track employee time, but the goal is to do so accurately. Time and attendance data is vital to calculating wages, and you must get it right from the start. Ensure you have an accurate record of this information to calculate salaries accurately. It’s best practice to have an automated system to capture and export employee time into timesheets. Doing so will help ensure accuracy and avoid time theft.

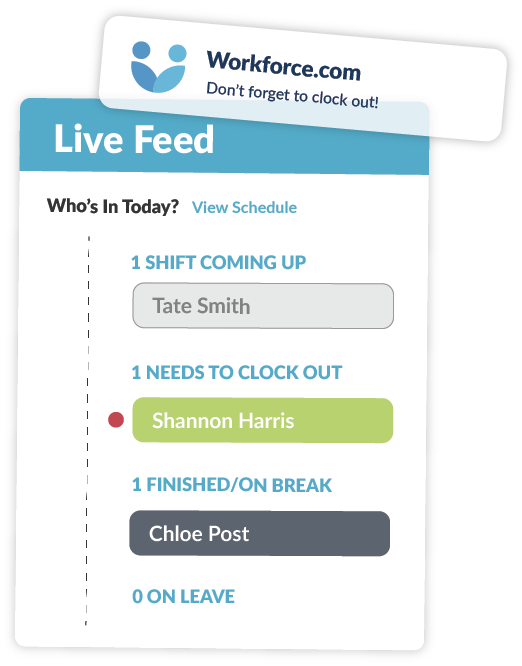

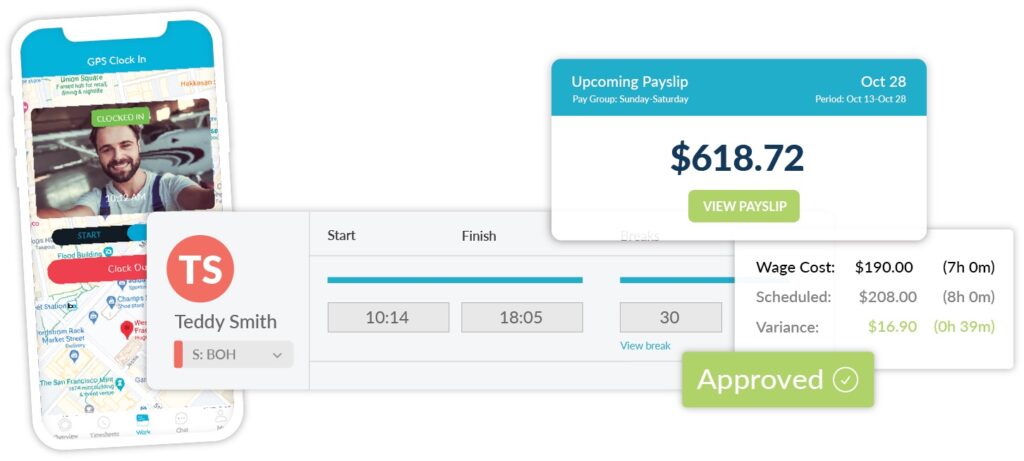

Workforce.com’s time and attendance system captures employee clock-ins and clock-outs in real time, automatically generating timesheets. It also sends alerts to both managers and employees if a punch is missed, reducing the need for manual cross-checking during payroll and maintaining the integrity of time records. Plus, employees can clock in directly from their devices with GPS tracking, which is ideal for workers in the field or businesses with multiple locations.

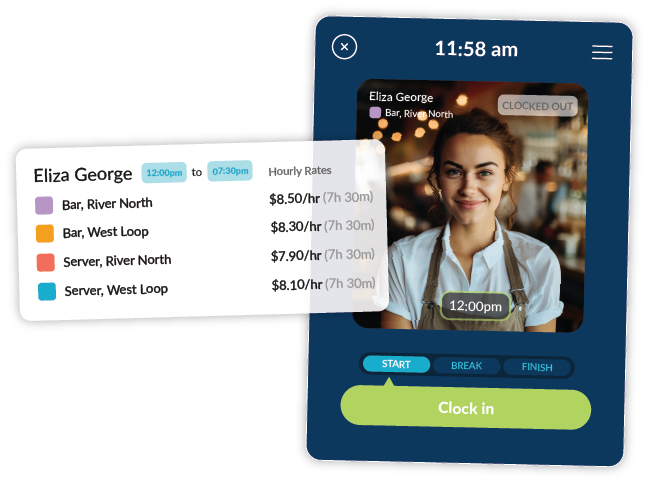

Calculate gross pay.

Determine the gross pay for each employee by multiplying their hours worked by their hourly rates or by dividing their salary by the pay periods if they’re salaried.

In order to do any of this, you first need to gather employee timesheets to determine how many hours each employee has worked. This is especially crucial for hourly employees, but you must also look at non-exempt salaried workers’ timesheet records in case they’re entitled to overtime pay.

Aside from their base pay, you must also factor in overtime, PTO, bonuses, and other incentives. Do you offer premium pay rates or shift differentials? Make sure that those are accounted for as well.

Furthermore, if you have employees who receive a significant amount of tips, you’ll need to track that as well and account for all applicable state laws.

Also read: Your guide to tipping laws by state

Note that there are state-based rules for computing overtime. Typically, overtime rates come into play when employees work more than 40 hours a week. However, some states have unique stipulations, like California. Employees who reach the 8-hour threshold in a day are paid 1.5x more per hour of overtime. And if they work over 12 hours, they are paid 2x their regular rate.

Yes, a lot goes into computing an employee’s gross wages, and clearly, it’s not just about adding up their work hours and corresponding base pay. Here are other relevant and useful guides to help you get started:

- Overtime Pay Laws | States + Federal (2024)

- What is time and a half + how to calculate it

- Exempt vs. non-exempt employees: knowing the difference

Compute and apply deductions.

After calculating gross wages, you need to factor in applicable deductions. Some of these are involuntary, while others are voluntary.

Involuntary deductions are mandatory under the law. Employers should subtract these amounts in compliance with applicable laws and remit them to tax agencies and other authorities. Common involuntary deductions include employee withholdings like FICA tax, Medicare tax, social security tax, federal income tax, state and local taxes, and wage garnishments.

Voluntary payroll deductions are amounts subtracted from an employee’s paycheck by their explicit choice or agreement. These deductions include retirement plans, health insurance, union dues, and other job-related expenses such as parking and travel. Some of these deductions are taken before or after taxes. It pays to double-check whether they are post-tax or pre-tax deductions.

Also read: What are different payroll deductions? Taxes, benefits, and more

Also, consider the necessary paperwork for deductions. There’s the W-4 for taxes and insurance forms for benefits, to name a few. Authorization to deduct is required for voluntary payroll deductions, so ensure your employees accomplish that and update when necessary. In addition, some employees may be exempt from FICA, so you need to consider that, too.

Free template: Payroll Deduction Authorization Form

Calculate net pay.

The net pay is the amount employees take home after all deductions. Subtract the total deductions from the gross income to find the net pay.

Pay your employees.

Pay your employees according to the set payment method and on the scheduled pay date. Make the necessary transactions and arrangements to ensure your staff receive their pay on time.

If you’re paying employees through direct deposit, account for how long it will take for the money to reflect in their bank account. Typically, it takes 1 to 3 days, but double-checking is still best.

File and remit taxes accordingly.

After determining federal, state, and local tax withholdings, you must remit these payments to the correct agencies. Depending on the tax type, you may either need to direct the funds immediately or reserve them and make the remittance closer to the payment deadline.

It’s also important to note that while employer contributions are not part of employee payroll, they are a core part of this process. Some contributions are paid by both employers and employees, such as Social Security and Medicare. Other obligations are solely on the side of employers, such as the Federal Unemployment Tax (FUTA).

Check with the appropriate agency for more information on handling tax rates and payments. For a complete list of employment taxes and their due dates, visit this full list from the IRS.

Keep payroll records and generate reports.

Create and review payroll reports to ensure accuracy and prepare for external audits. This includes reports for tax filings, financial statements, and employee records.

You must also create reports required by government agencies such as the IRS. Typically, such reports inform the agencies about wages paid to employees, withheld taxes, and employer contributions. Note that these reports may have different deadlines and require specific forms. For instance, Form 941 is used to report an employer’s quarterly federal tax return, while Form 940 is in relation to FUTA.

Furthermore, the FLSA mandates employers to keep payroll-related for three years.

Also read: A guide to accurate and comprehensive payroll reports

You can easily generate payroll reports to get a better understanding of your business and payroll expenses. Workforce.com helps you stay on top of government requirements and also lets you create reports that show how your payroll connects to frontline work and employee performance.

Things to Consider Before Doing Payroll Yourself

If you’re leaning toward doing payroll manually, here are factors you need to carefully weigh before doing so:

Cost

Doing payroll yourself can save you costs in terms of not having to pay for software or outsourcing payroll. That’s where the appeal comes from, especially if you have a small workforce of 5 to 10 employees.

However, it’s not just about whether or not to pay for a service, which brings us to the next point.

Time

Doing payroll yourself requires time – and a lot of it. If you have a growing business, the hours spent processing payroll yourself can sometimes end up costing you more than outsourcing the work.

Consider the opportunity cost of spending a day gathering data, making calculations, cross referencing computations with the latest federal, state, and local laws, staying on top of taxes, and submitting reports. What else could you be doing instead?

All of this work can be incredibly challenging when you have a scaling business. Processing payroll may be manageable for staff with 5 team members, but it can quickly become much more complex when you’re doing it for 50 employees. Not being able to manage your time well can also result in a delayed payroll, which is the last thing you want to happen.

Legal risks

If you or someone on your team is well-versed in tax laws and payroll regulations, doing it in-house might be feasible. However, manually processing pay is risky – errors are inevitable. If you’re doing payroll in a spreadsheet, one wrong entry or a single typo could cause a chain reaction of errors, making you legally liable for inaccurate pay. You can opt to double-check or even triple-check your calculations, but routinely doing so will make payroll take even longer, which, as discussed earlier, can also cost you.

Another risk of manually processing payroll is the potential for employee misclassification. Ensure you understand which staff to classify as independent contractors vs. full-time employees.

Support

When you do payroll yourself and encounter issues, it’s up to you to figure out answers or solutions. This situation can be daunting and complicated. Of course, resources are available, but combing through data sheets and government guidelines can be time-consuming, overwhelming, and prone to misinterpretation.

Operations

If your business is seasonal or operates temporarily, manual payroll might make the most sense since it’s not something you will be doing year-round. But then again, consider the number of employees you have. Choosing a payroll tool might be worth considering if you have a big workforce, even if you won’t be running payroll year-round.

Why Using Payroll Software Makes Sense

Quick answer: automation and accuracy.

Payroll software helps simplify calculating wages, accounting for labor laws, withholding taxes, bookkeeping, and generating reports. It handles all the vital administrative areas of payroll faster than you would manually do.

If you run a small business, payroll software helps you stay hands-on with your pay runs, but this time, you can make computations quickly and error-free. Furthermore, if you’re a growing business, payroll software can scale with you and handle the process even as you hire more team members.

Also read: 14 Best Payroll Software Services in 2025

Features of payroll software to look for

If you’re planning to look at payroll solutions, go for software that has the following functionality:

Synced with your time tracking system

Much of the payroll process happens even before the part where you calculate wages. This means that the success of your payroll depends on how accurately you record work hours.

Ideally, your payroll should sync directly with whatever you use to track time and attendance. This way, you can easily process employee time automatically without re-entering or exporting it into payroll.

Automated calculations

Payroll software should be able to automatically compute wages, deductions, and taxes. At the same time, it should account for applicable taxes and labor rules.

The thing with payroll processing is that every paycheck is different. Your payroll system should account for all these nuances and differences, especially if you employ hourly employees in various locations.

Go for a payroll system that can handle computations for different employee classifications, pay rates, overtime, tips, deductions, and withholdings.

Employee self-service

Make payroll information accessible to everyone at your business. Staff should be able to update their personal details and direct deposit information via an online portal or app. This eliminates the need for a middleman; employees handle their own profile changes instead of wasting time asking management.

User-friendliness

While any new software has a learning curve, it is important that you choose one that is intuitive and well-designed. Small businesses don’t have the large departments or specialized expertise required to handle complex legacy systems. Go for an easy-to-use payroll platform that offers quality support—from importing your current data to ensuring that your first pay runs are accurate and smooth.

Do payroll in minutes with Workforce.com

Workforce.com helps reduce payroll processing time from hours to as little as 20 minutes. It automates adjustments, keeps staff details up to date with self-service features, and sends out incomplete timesheet reminders, taking care of the things that typically slow down and complicate payroll processing.

It can handle tax forms such as W-2s and 1099s, direct deposits, tax filing, wage garnishments, deductions, multiple pay runs, benefits, and payroll reporting. Workforce.com’s payroll software even syncs with other important functions like time tracking, scheduling, hiring, and more.

Discover how Workforce.com can simplify payroll for your small business by booking a demo today.